The Hass Horn: Looking back on 'Occupy APEAM'

By avocado industry veteran Avi Crane

As Independence Day was being celebrated in the USA, the avocado harvest in Mexico was stopped and access to the offices of APEAM (Association of Michoacán Avocado Producers and Packers) was denied by protesters. The leaders of the strike presented two conditions to resume the harvest:

As Independence Day was being celebrated in the USA, the avocado harvest in Mexico was stopped and access to the offices of APEAM (Association of Michoacán Avocado Producers and Packers) was denied by protesters. The leaders of the strike presented two conditions to resume the harvest:

1. Packing Houses certified to process avocados for the USA market must pay a minimum of 45 pesos per kilo (on-tree/all sizes and grades) and:

2. Each PLU sticker must now include the text “Producto de Michoacán” so that the export market can distinguish between the quality of Hass avocados grown in Michoacán and in Jalisco. The assumption being that the market will pay a premium for production from Michoacán (An assumption that has yet to be tested in the market).

There have been reports circulating that the actual instigators/leaders were not part of the avocado industry and that these outsiders had their own agenda in orchestrating the strike. The economic impact on the city of Uruapan and the surrounding areas was evident.

Packing house workers were furloughed, harvest crews were disbanded and trucks used to transport the 1000+ loads to the border sat idle. By the third week of July, avocado industry leaders had vanquished the leaders of the strike and the harvest resumed. The main benefactors to the almost three-week strike were avocado growers in California who saw a huge rise in field prices and Peruvian avocado growers who realized a substantial increase in the value of their unsold inventory in the USA.

The avocado market in North America is as strong today as it was weak in May and early June. So far, 2016 has broken many records. For example, in Week 4 just under 2.5 million cartons were shipped – a weekly record, and week 29 volume was a record for a week in July; obviously, this large volume was due to the urgency to replenish the inventory after the reduced volume due to the strike.

Avocado consumption at the retail and food service marketplaces continues to outpace supply. The massive industry promotional programs continue to ensure that per capita avocado consumption will continue to increase in the USA. Over US$60 million will be assessed by the Hass Avocado Board (HAB) in 2016. This does not include additional assessments by the California Avocado Commission and APEAM.

There are 38 avocado packing houses in Michoacán that are certified by the United States Department of Agriculture (USDA) to ship product to the USA and are in possession of an active APEAM membership license (the current payment required to obtain a new license is US$250,000).

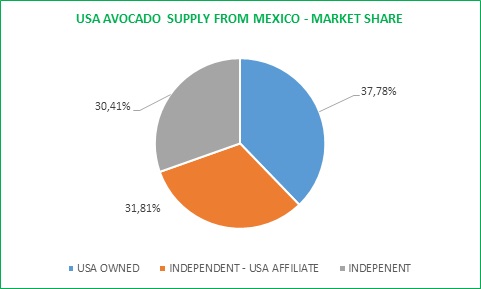

However, just 10 of the packing houses ship almost 65% of the volume. Close to 40% of the volume is packed in facilities owned by U.S. companies and two-thirds of the total weekly volume are shipped to companies who have been marketing avocados before Mexican avocados gained access to the U.S. market – many for decades.

In my analysis, this explains why the market has been positive for producers, marketers, retail, food service and wholesalers and the end consumer during the surge in avocado consumption in the past decade - and it is the reason that the forecast is so positive for this category.

Avi Crane is a former executive of Calavo Growers, Inc. (CVGW). Crane served as vice-president at the California Avocado Commission, established and managed the Chiquita avocado program and began his career in the avocado industry as a producer. Currently, Avi Crane is working directly with producers to help maximize their returns from the market in North America. He can be reached at avicado@worldavocados.com.