Chile: Decofrut downgrades Crimson grape export forecast amid color setbacks

Decofrut director Manuel José Alcaíno says the situation is unprecedented but emphasizes "there will be fruit"; traders will just need to make sure they differentiate supply and keep prices reasonable to keep grapes moving in the market.

Santiago-based consulting and research company Decofrut has cut its estimates for Chilean Crimson Seedless table grape exports by 15% for the 2016-17 campaign, after a low variance in day versus night temperatures led to an unusual lack of coloring in the variety.

Warm weather meant that like other cultivars, the Crimsons were harvested early and shipped early, leading to exports of 9.2 million boxes in the season to week 11.

This represents a year-on-year hike of 37% but previous estimates indicated the total volume would remain steady compared to 2015-16, just shy of 19 million boxes.

"We have adjusted this estimate of 19 million boxes to 16.2 million, a loss of 15% more or less as a product of coloring this year," Alcaíno told Fresh Fruit Portal.

"There is very little experience of this in Chile because it’s never happened to us before that the fruit doesn’t have the coloring. The Crimsons have always had good color, in contrast to what happens sometimes in California.

"The fruit ripened earlier, it has good sugar, has the right grades for harvest, but it hasn’t taken the color that it needs. Based on that, we thought some of the fruit won't be exported," he says.

He highlights the fruit that lacks color will still be delicious to eat, but overseas markets demand good coloring in the grapes.

"Firstly you have to do the selection. If it has low coloring obviously you don’t pack it; what has a bit less color than normal can be exported but it has to be differentiated so it doesn’t affect the prices of the good fruit," he says, noting growers have waited a bit longer for harvest to ensure sweetness and improve color somewhat.

"You can't suppose you’ll get the prices of the usual fruit. That wouldn’t be realistic.

"However, in the American market there is a lot of experience trying to trade fruit without color as it happens with some frequency to the Californians, and when the fruit doesn’t have color it clearly complicates sales."

The U.S. is by far the largest market for Chile, and under the previous estimate Decofrut would have expected 4.3 million more cartons of Crimsons to be sent to the country for the rest of the season.

One could assume a 15% drop in the total crop would lead to a corresponding cut in U.S.-bound exports, but Alcaíno expected weak markets in Europe and South Korea would likely lead to a greater proportion of fruit going to North America through March and April.

"So my estimate is that from week 11 the U.S. will receive 3.2-3.5 million boxes," he said.

"Last year from week 11 onwards 5.1 million boxes were sent, and in the previous season in 2014-15 there were 6.9 million.

"So 3.2 million boxes for the date is a limited quantity compared to previous years, but it’s a quantity that the United States will have in addition to the storage grapes."

In terms of white seedless, Alcaíno said the U.S. market was very short on the variety and given Chile's growing conditions had been good with little rainfall and humidity, results ought to be "fantastic" for the best quality fruit but there would still be a wide range of pricing depending on condition.

He expected both white and red seedless should be able to have sufficient volumes of good fruit in the U.S. for the transition into the Mexican table grape season when the country's first Perlette volumes hit the market late next month.

Non-U.S. market wrap

While the U.S. had by far the biggest volume increase in Chilean Crimson exports in the season to week 11, to the tune of an extra 904,704 boxes year-on-year, the biggest percentage rises were seen elsewhere.

The Middle East received 11 times more at 3,890 boxes, but this is just a miniscule portion of the total supply. Larger markets like the EU (+143%; 1.4 million boxes) and the Far East (+48%; 1.6 million boxes) were able to absorb much of the faster-ripened supply.

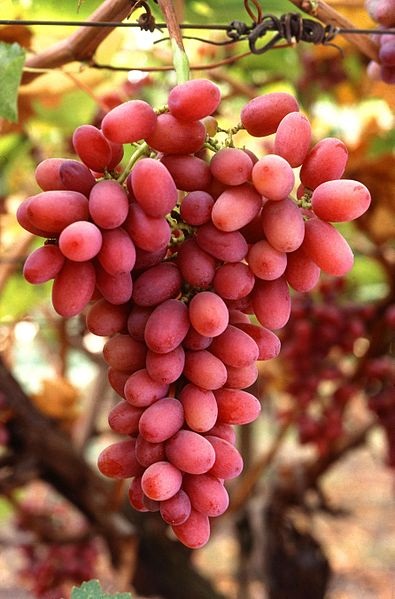

Headline photo: www.shutterstock.com