Agronometrics in Charts: Hass avocados see firm prices in U.S. market

In this installment of the ‘Agronometrics In Charts’ series, Cristian Crespo F. illustrates how the U.S. market is evolving. Each week the series looks at a different horticultural commodity, focusing on a specific origin or topic visualizing the market factors that are driving change.

In this week's article of our "Agronometrics In Charts" series, we will look at Hass avocado prices and volumes in the U.S. market.

In a previous article, we talked about a break in prices for Hass avocado in the U.S. market.

Although prices have stabilized a bit, the trend of good prices has continued and is probably due to lower volumes from Mexico, the main supplier of the fruit to the North American market.

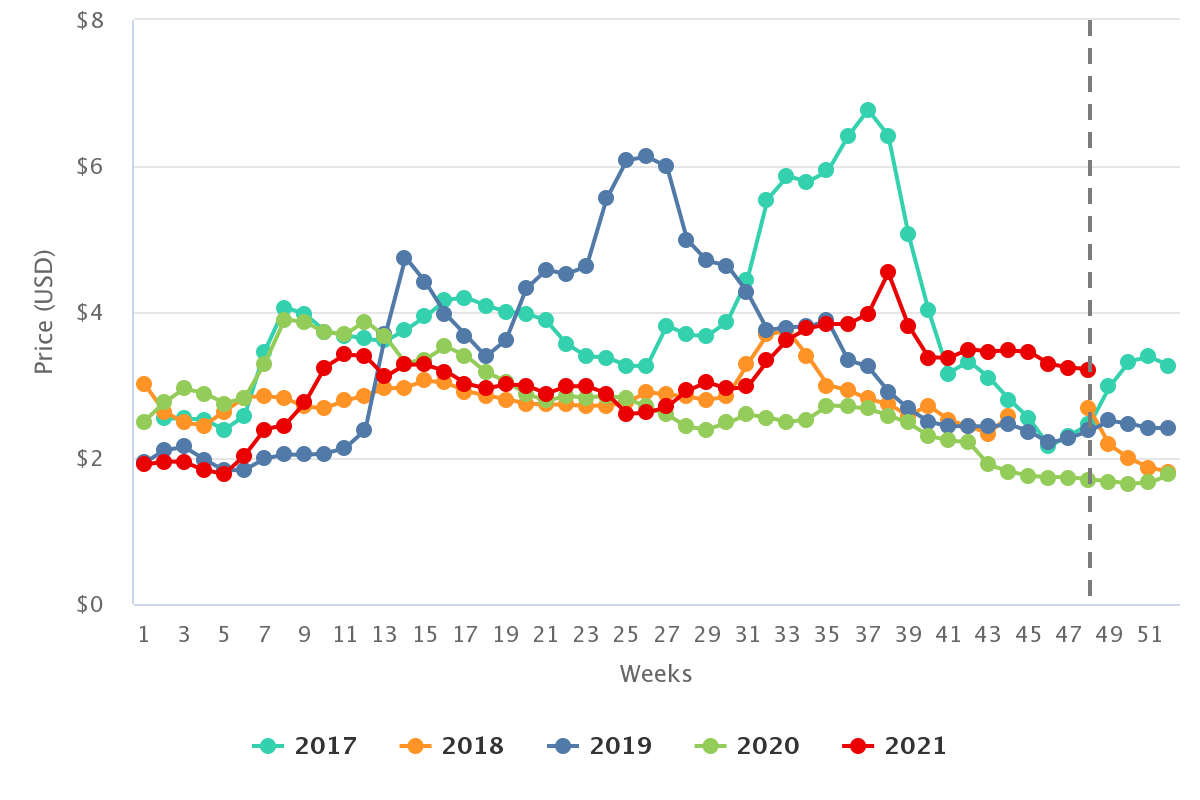

We can see in the graph below that in week 49 the price of conventional Hass avocados in the North American market was around US$3.22 per kilogram, representing an 88 percent increase year-on-year. Currently, prices of Hass avocados are being recorded from Mexico.

Price of conventional Hass avocados in the U.S. market (USD/KG)

(Source: USDA Market News via Agronometrics) [Agronometrics users can view this chart with live updates here]

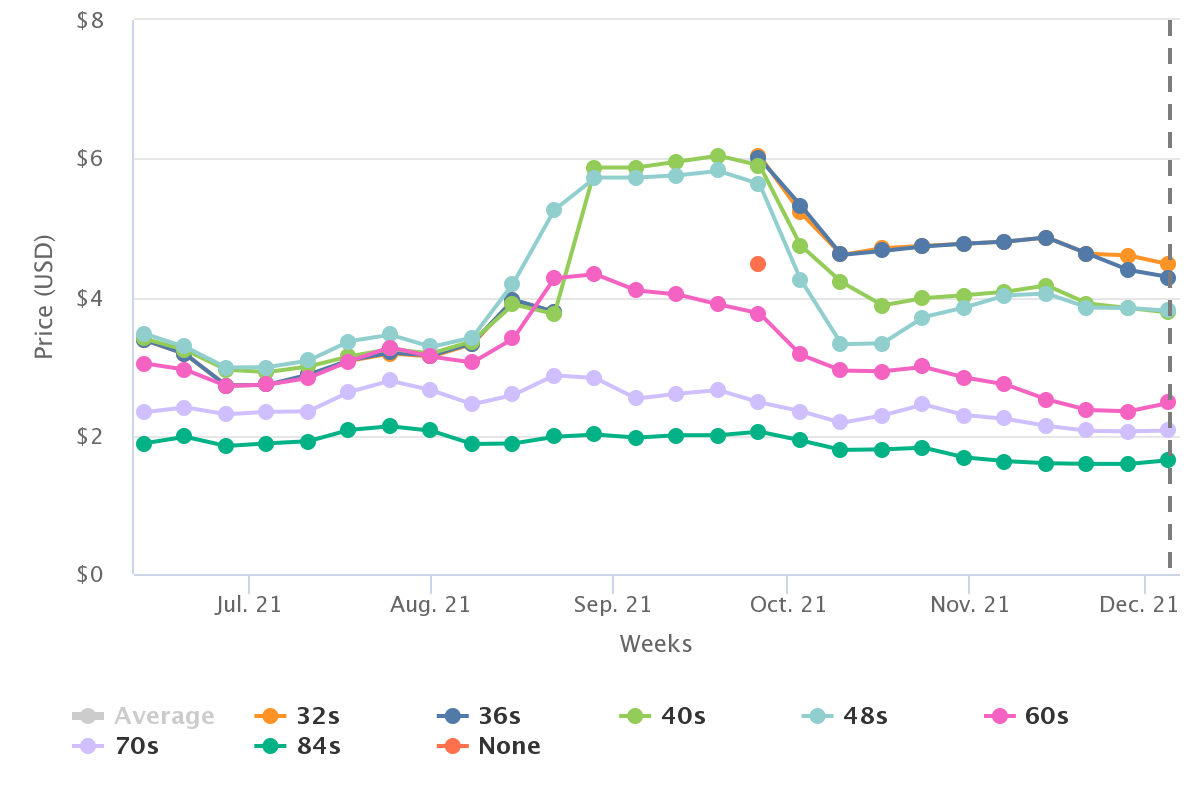

Regarding the average prices of the various sizes of Hass avocados in the U.S. market, we can see in the graph below that in general, the best prices are being seen by the largest sizes.

Size 32s are looking at average prices of US$4.47 per kilogram, and the lowest prices at US$1.64 per kilogram are for 84s. This shows a difference of up to 173 percent between one price and another.

Hass avocado prices in the U.S. market, by size (USD/KG)

(Source: USDA Market News via Agronometrics) [Agronometrics users can view this chart with live updates here]

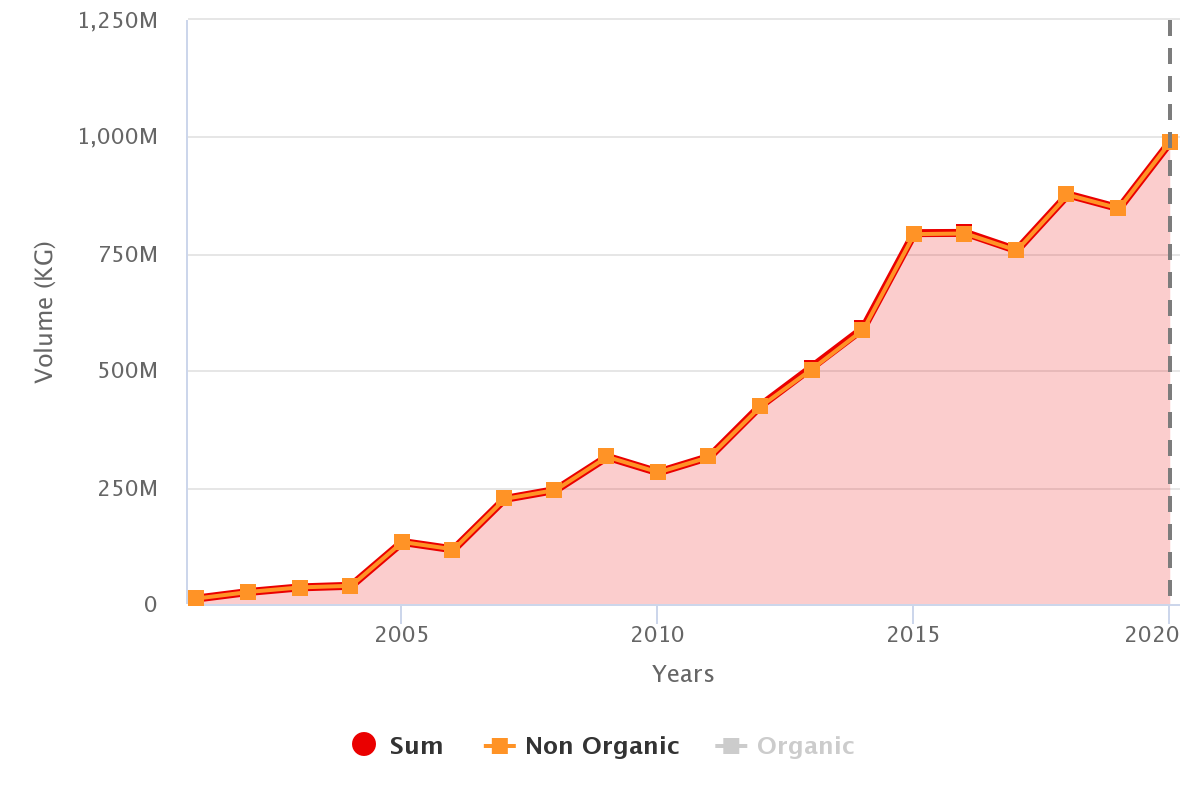

This increase in prices seen in the North American market may have been due to, among other reasons the decrease in Mexican avocado supplies over the last four months compared to the previous year. This is despite that November of this year saw very similar volumes between the two years.

Volume of avocados from Mexico in the U.S. market (KG)

(Source: USDA Market News via Agronometrics) [Agronometrics users can view this chart with live updates here]

(Source: USDA Market News via Agronometrics) [Agronometrics users can view this chart with live updates here]

The other "good news" is that the North American market seems to be absorbing Mexican avocado volumes in a fitting way. Volumes increase year after year, as we can see in the graph below, without prices collapsing.

Although the question that always arises is: How much more volume can the U.S. market absorb from Mexico? And the likely increase in volumes from emerging markets such as Colombia and other markets such as Chile and Peru will have an impact.

Historical volume of Mexican avocados in the U.S. market (KG)

(Source: USDA Market News via Agronometrics) [Agronometrics users can view this chart with live updates here]

In our ‘In Charts’ series, we work to tell some of the stories that are moving the industry. Feel free to take a look at the other articles by clicking here.

You can keep track of the markets daily through Agronometrics, a data visualization tool built to help the industry make sense of the huge amounts of data that professionals need to access to make informed decisions. If you found the information and the charts from this article useful, feel free to visit us at www.agronometrics.com where you can easily access these same graphs, or explore the other 20 fruits we currently track.