Agronometrics in Charts: Fruit exporters face “worst time” as U.S. tariffs on Brazil threaten shipments

In this installment of the ‘Agronometrics In Charts’ series, we take a look at the impact of U.S. tariffs on Brazilian fruit exporters. Each week, the series looks at a different horticultural commodity, focusing on a specific origin or topic, visualizing the market factors that are driving change.

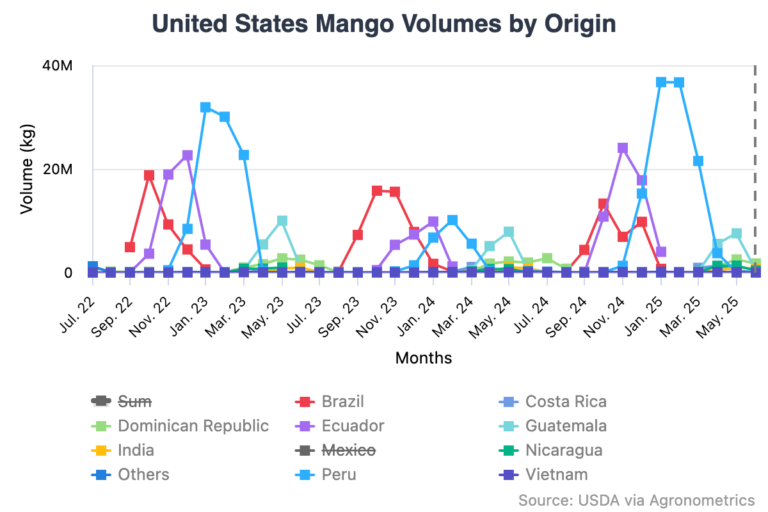

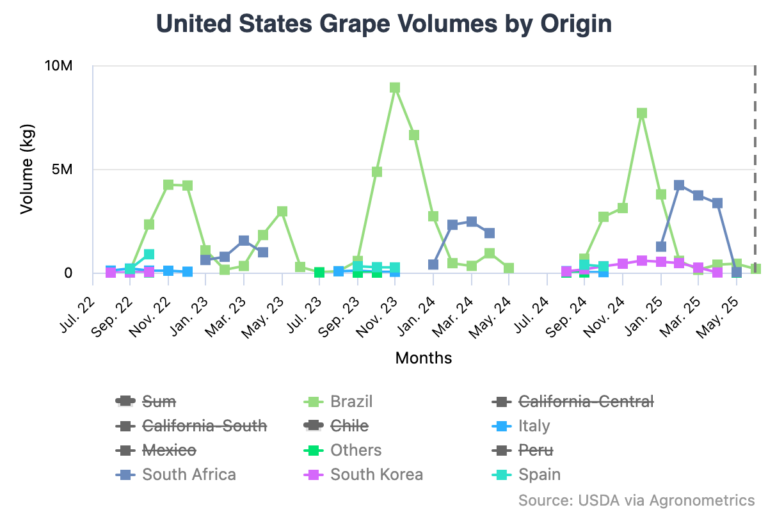

Brazil’s fruit export industry is reeling from the United States' decision to impose a 50% tariff on select Brazilian agricultural products. Mangoes, citrus, and grapes, which account for 90% of Brazil’s fruit shipments to the U.S., are set to take the biggest hit, and timing couldn't be worse—the new tariff will take effect August 1, just as Brazil's mango harvest peaks.

“This couldn’t have come at a worse time,” says Luiz Roberto Barcelos, institutional director at the Brazilian Fruit Growers and Exporters Association (Abrafrutas). “Everything was ready for harvest, space booked on the ship, packaging purchased, protocols followed, everything lined up to start the season.”

Now, approximately 70,000 tons of mangoes intended for the U.S. market must be rerouted to either Europe or the domestic market, both of which are already saturated and unlikely to absorb a larger volume. This redirection raises serious concerns about oversupply and sharp price declines. Some producers are considering letting fruit rot on the trees, says Barcelos, as harvesting and logistics costs may exceed any potential return.

The uncertainty about how long the tariff will remain in place is also discouraging growers from investing in future seasons: “With a 50% tax, Brazilian fruit is practically unmarketable in the U.S.,” he added.

The trade victims' list continues to grow

Grapes from the São Francisco Valley begin harvest in mid-November, and they're likely to be the next export category to get painfully hit by the U.S. tariff. Even avocados, which were on the verge of gaining access to the American market, have been caught in the crossfire, and now negotiations have stalled amid rising trade tensions.

With no contingency market of comparable size, industry leaders are urgently appealing for diplomatic intervention. “We hope that dialogue can overcome any trade friction, and that there will be a review and revocation of this possible tariff implementation,” said Valeska Oleiveira Ciré, Brazil country manager for the International Fresh Produce Association. “We are pursuing dialogue and working to inform both governments about the implications of this decision. On the other side, American consumers also expect to continue buying mangoes at competitive prices.”

As the industry holds its breath, the stakes remain high for Brazil’s growers and global fruit markets, which may soon face the consequences of redirected volumes, volatile pricing, and disrupted trade flows.

Source: USDA Market News via Agronometrics.

(Agronometrics users can view this chart with live updates here)