Agronometrics in Charts: California table grape acreage declines, imports surge

In this installment of the ‘Agronometrics In Charts’ series, we take a look at acreage in the California table grape industry. Each week, the series looks at a different horticultural commodity, focusing on a specific origin or topic, visualizing the market factors that are driving change.

California’s table grape sector is undergoing notable shifts as acreage declines and import volumes hit new highs, according to the USDA’s July 2025 Fruit and Tree Nuts Outlook.

Table grapes now account for just 15% of California’s total grape acreage, a trend that continues from 2024, when acreage experienced a 4% decrease from the previous year. On the other hand, productivity is trending upward, with nearly all (96%) of the planted area bearing fruit. Flame Seedless remained the most common variety, followed by Autumn King and Scarlet Royal. Together, these three made up 28% of California’s table grape acreage.

The 2024/25 marketing year (May 2024 to April 2025) saw U.S. fresh grape exports jump 23% year-over-year to 496.5 million pounds, a rebound that followed the disruption caused by Hurricane Hilary the previous season. Canada and Mexico together accounted for two-thirds of all U.S. exports, up from less than 40% a decade ago. Certified organic grapes made up 8% of total exports.

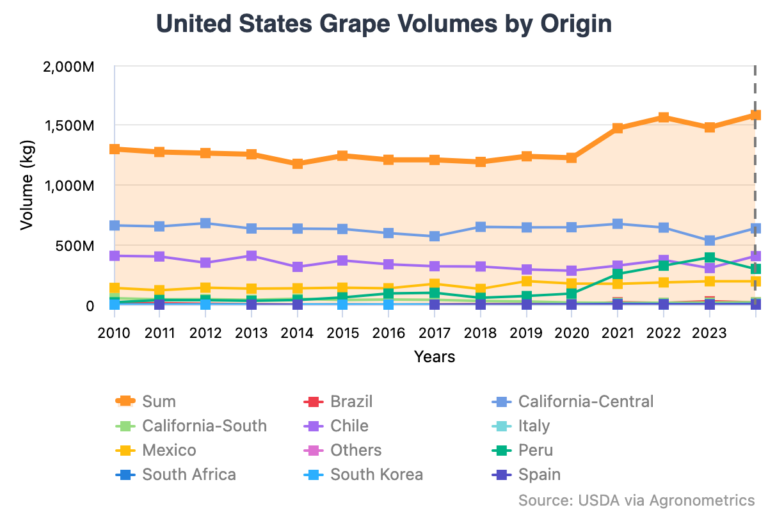

Fresh grape imports surpassed 2 billion pounds for the first time during the 2024/25 season, marking a 15% year-over-year increase. Imports have climbed steadily since 2021/22, driven primarily by increased shipments from Peru, Chile, and Mexico, which together supplied 97% of all imported grapes.

Peru experienced a major recovery in 2024/25, with import volumes surging 46% year-over-year after poor weather conditions hampered yields in 2023/24. Chilean imports also rose despite acreage reductions, while imports from Mexico fell 9%.

While USDA's full 2025 grape production forecast is due in August, early movement data shows California’s summer shipments running behind last year, even though harvests began a week earlier. Coachella Valley started shipping in mid-May, followed by the San Joaquin Valley in July. Early conditions in both regions were reported as favorable.