Agronometrics in Charts: The secret behind Peruvian table grapes' rise to the top of the global market

Each week, the series ‘Agronometrics In Charts’ looks at a different horticultural commodity, focusing on a specific origin or topic, and visualizing market factors that are driving change. Check out our entire archive.

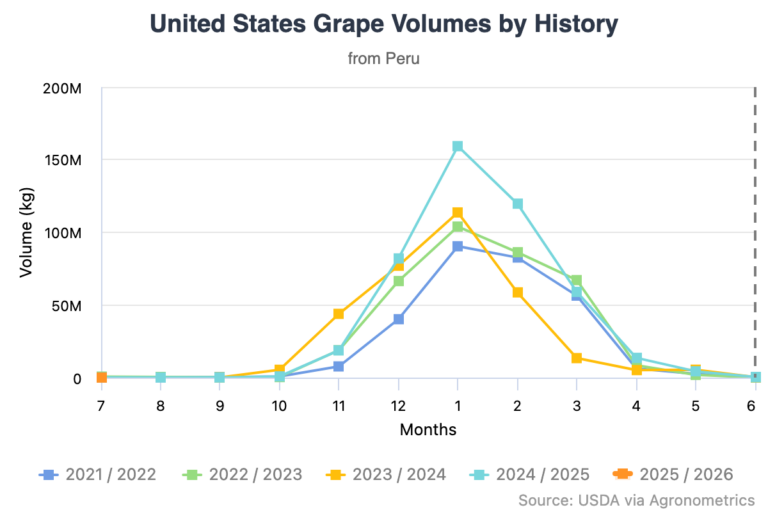

Peruvian table grapes are heading into the 2025-26 export season with strong momentum and high expectations.

Preliminary forecasts project a 9 percent increase in FOB export value, with the potential to exceed $2.3 billion if growth and market conditions align. Even under less ideal scenarios, growth is still expected to rise at least 5 percent. This continued upward trend reinforces Peru’s position as the world’s top table grape exporter, having surpassed the U.S. and Italy in recent years.

The country’s rise is no accident, but the result of a focused strategy that combines the adoption of high-performing patented varieties, a clear shift toward white seedless grapes, and precision irrigation in arid regions like Piura. Sharp commercial timing aimed at high-value windows has also played its part, granting the country market access to the United States. The results speak for themselves, as Peru now exports grapes to over 40 international markets.

However, leadership won’t come easily, as the competition is intensifying (Chile’s exports grew 14 percent last season, while China’s increased 21 percent), and the global table grape trade exceeds $12 billion annually.

Peruvian table grapes cater to consumer trends

Price pressure and climate challenges, especially in regions vulnerable to El Niño and La Niña, are forcing Peruvian exporters to fine-tune every part of the supply chain. One of Peru’s key advantages has been its rapid varietal transformation. A decade ago, only 16 percent of planted hectares featured patented varieties. Today, it’s nearly 75 percent, with more than 60 modern export varieties aligned with consumer trends, particularly the strong global preference for white seedless grapes.

Peru has found a way to understand what consumers want in terms of varieties. That insight, paired with agility and investment in innovation, has turned Peru into a dominant force in global grape exports. With the 2025-26 season set to begin in October, Peru isn’t just aiming to grow—it’s geared up to lead.