Agronometrics in Charts: US pear crop rebounds from 2024 lows, but long-term decline persists

Each week, the series ‘Agronometrics In Charts’ looks at a different horticultural commodity, focusing on a specific origin or topic, and visualizing market factors that are driving change. Check out our entire archive.

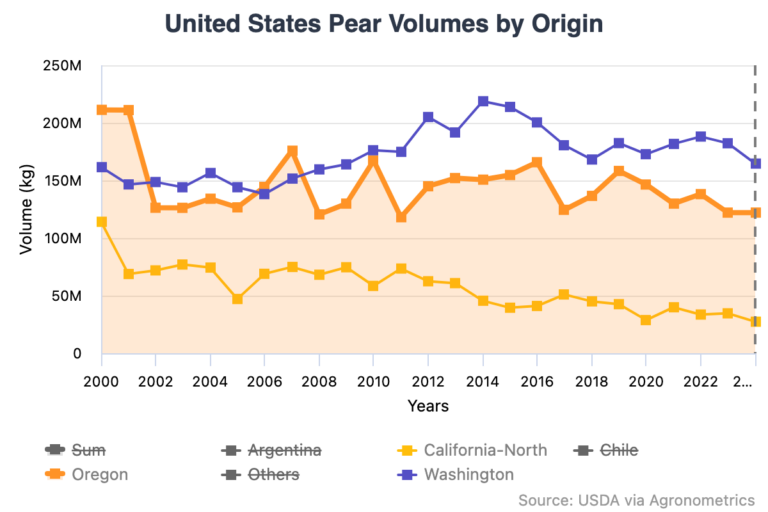

According to the September version of the Fruit and Tree Nuts Outlook released by the USDA, the latest forecast for the 2025 US pear crop signals a modest rebound but highlights a longer-term decline in the sector. According to the forecast, total production is projected at 625,000 tons, up 22 percent from 2024’s historically low volume, but this is still 7 percent below the average for 2021-2023. If the forecast holds, this season would mark the second-lowest US pear crop since 1972, continuing on a broader pattern of contraction.

In 2024, US pear output fell to its lowest level since 1967; this was the result of widespread weather-related setbacks across key growing states. Conditions in 2025 have improved, with better yields expected in Washington, Oregon, and California. Washington, the country’s top-producing state, is forecast to produce 280,000 tons, which is an increase of 46 percent from last year’s short crop. Still, that figure remains 5 percent below Washington’s recent three-year average. Favorable growing conditions during spring and summer helped drive yield recovery, with Bartlett and D’Anjou varieties continuing to dominate production. Bartletts are typically harvested in late summer, while D’Anjou pears, known for their storage life, extend availability well into the following year.

Oregon’s production is estimated at 210,000 tons, which represents a 5 percent gain over 2024 but still falls short of the state’s three-year average. California, where more than half the crop is typically processed into canned pears and fruit cocktail, is forecast to produce 135,000 tons. That’s a 14 percent increase from the previous year, though it, too, lags behind its recent performance. The processing sector has been a significant factor in the overall decline in pear production, as demand for canned fruit continues to trend downward.

While the 2025 crop is showing signs of recovery in volume, US fresh pear exports have hit a significant low. In the 2024/25 marketing year (July to June), fresh pear export volume dropped to 159 million pounds, the lowest since the 1988/89 season. This marked the first time the United States became a net importer of fresh pears. Compared to the previous year, exports of conventionally grown pears fell 39 percent by volume and 24 percent by value. Organic pear exports also declined, 25 percent by volume and 16 percent by value, amounting to 51.3 million pounds, or roughly one-third of total fresh pear exports.

Source: USDA Market News via Agronometrics.

(Agronometrics users can view this chart with live updates here)

Source: USDA Market News via Agronometrics.

(Agronometrics users can view this chart with live updates here)

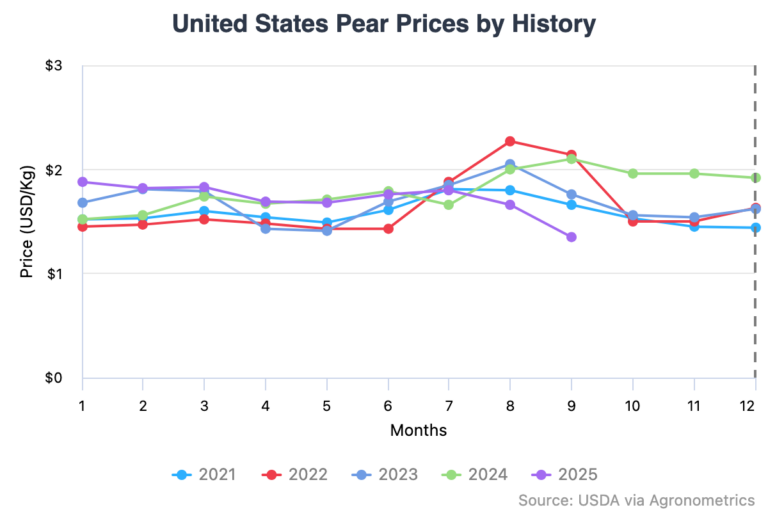

Looking at price trends for 2025, pear prices during August and September were notably lower than in prior years, despite the historically low production. While volumes recovered modestly this season, the lack of a strong price response points to a market still rebalancing after consecutive challenging seasons.

Mexico remained the dominant destination for U.S. pears, receiving 57 percent of conventional exports and 90 percent of organic exports during the season.

The outlook for the U.S. pear industry remains mixed. While yields have improved and the current season is outpacing the disastrous 2024 harvest, structural challenges persist. Declining demand for processed pears, volatile weather conditions, and weakening export competitiveness continue to weigh on the sector. With production volumes still near historic lows and the U.S. losing ground in global markets, the industry faces pressure to adapt. How it responds, through varietal investment, marketing innovation, or new trade strategies, may shape the future trajectory of U.S. pears in both domestic and international markets.