Agronometrics in Charts: US solidifies role as top market for Peruvian produce, driving 20% export growth

Each week, the series ‘Agronometrics In Charts’ looks at a different horticultural commodity, focusing on a specific origin or topic, and visualizing market factors that are driving change. Check out our entire archive.

Written by Sarah Ilyas, from Agronometrics.

The United States has reinforced its position as the most important destination for Peruvian produce exports in 2025. According to Fresh Fruit Peru, Peruvian shipments to the US reached $3.69 billion between January and October, a 20 percent increase compared with the same period in 2024.

Even during months affected by the temporary 10 percent tariff, demand from the US remained strong, underscoring the market’s deep preference for Peruvian produce.

The recent reinstatement of zero percent tariffs on 100 Peruvian produce has added renewed competitiveness, allowing exporters to recover margins and face peak-season demand with greater stability.

A long-standing relationship with Peruvian produce

For more than a decade, the US has consistently absorbed one-third of Peru’s total agricultural exports, making it the country’s primary commercial anchor.

From blueberries and grapes to avocados and coffee, the alignment between Peru’s production calendar and US consumption windows has created a reliable, year-round flow of shipments.

In 2025, blueberries, coffee, grapes, and avocados alone accounted for over $2.2 billion, driven by strong volumes and favorable seasonal windows in the North American market.

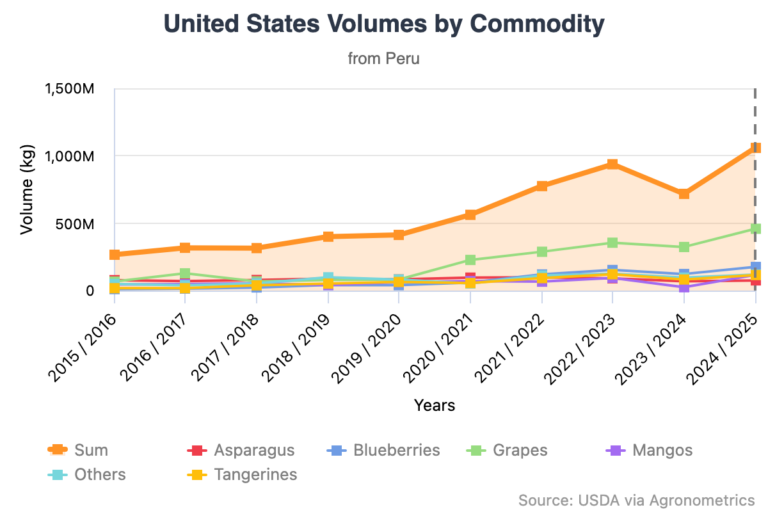

Source: USDA Market News via Agronometrics.

(Agronometrics users can view this chart with live updates here)

The impact extends beyond trade. More than 1,000 Peruvian companies currently ship agricultural products to the United States, generating an estimated 473,000 formal jobs nationwide.

Key producing regions such as Ica and La Libertad depend heavily on this demand, which in turn fuels investment, expansion of planted area, and processing activity.

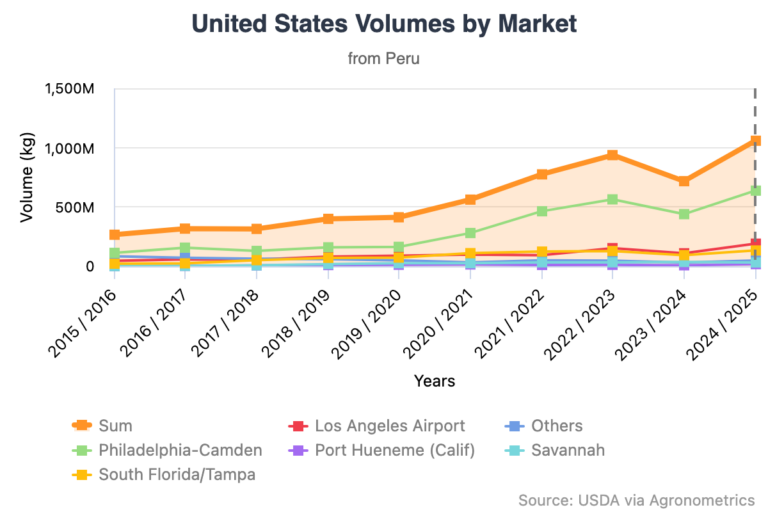

Increasingly efficient logistics have supported this growth. Nearly all shipments to the US leave Peru via maritime routes, with ports such as Callao, Paita, Paracas, and Matarani connecting directly to major entry points, including Philadelphia, Miami, Savannah, Los Angeles, and Hueneme.

These routes have shortened delivery times and strengthened Peru’s reputation for reliability and product quality.

Source: USDA Market News via Agronometrics.

(Agronometrics users can view this chart with live updates here)

Yet alongside these opportunities comes a structural challenge.

With around 33 percent of Peruvian produce exports concentrated in a single market, any change in US regulations, logistics, or sanitary standards carries significant risk. While the US will remain Peru’s most profitable and strategic destination, long-term competitiveness will also depend on opening new spaces in Europe, Asia, and the Middle East.

Peru enters the end of 2025 with strong momentum. If current trends continue, agricultural exports to the US could surpass $5.2 billion, setting a new record and confirming the country’s position as one of the United States’ most important and trusted suppliers.

The challenge moving forward will be balancing this success with market diversification, ensuring that growth remains both dynamic and resilient.

Related stories

Strong global demand drives US fresh produce exports above $11B