Agronometrics in Charts: Record-breaking Peruvian blueberry exports top $2.5B amidst global market diversification

Each week, the series ‘Agronometrics In Charts’ looks at a different horticultural commodity, focusing on a specific origin or topic, and visualizing trade market factors that are driving change. Check out our entire archive.

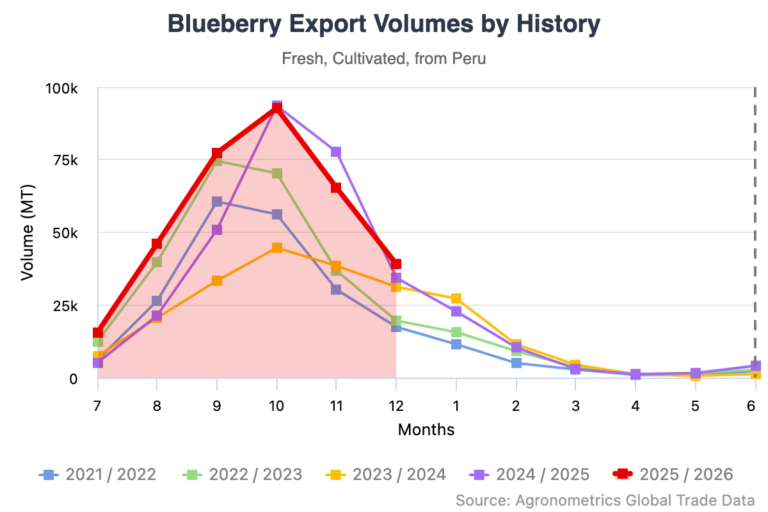

The Peruvian blueberry sector closed 2025 with a historic milestone, surpassing $2.5 billion in exports for the first time. Preliminary figures from Fresh Fruit Peru indicate that shipments reached $2.563 billion and 412,239 tons, confirming Peru’s position as the world’s leading exporter.

Compared with 2024, export volume increased by 17 percent while export value rose by 13 percent. This growth was achieved in a year marked by strong supply expansion and a corresponding adjustment in prices, with the average export price closing at $6.22 per 2.2 lbs., around three percent lower than the previous year.

Source: USDA Market News via Agronometrics.

(Agronometrics users can view this chart with live updates here)

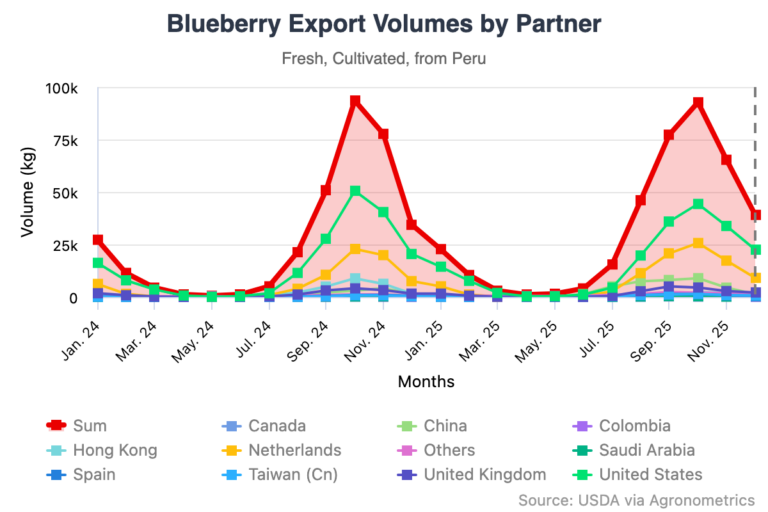

On the destination side, Peruvian blueberry exports reached 66 markets in 2025, up from 52 in 2024. While exports remained concentrated, diversification continued to deepen. The five largest destinations accounted for 90 percent of total export value, down from 94 percent the previous year.

The United States remained the leading market, though its relative share declined as shipments were redistributed. Export value to the United States edged slightly lower, while volumes increased, reflecting a more competitive pricing environment.

The Netherlands strengthened its role as Europe’s primary gateway, posting strong growth and increasing its share of total exports.

China represented the most significant structural shift of the year, more than doubling its import value and expanding its share to ten percent. At the same time, exports to Hong Kong declined sharply, reflecting a reconfiguration of Asian flows as direct access to mainland China expanded.

Source: USDA Market News via Agronometrics.

(Agronometrics users can view this chart with live updates here)

These shifts suggest a deliberate commercial adjustment. As total supply increased, exporters redirected volumes toward markets with greater absorption capacity, even in cases where achieving premium prices became more challenging.

Growth in Europe and China helped offset pressure in traditional markets and supported overall export expansion despite lower average prices.

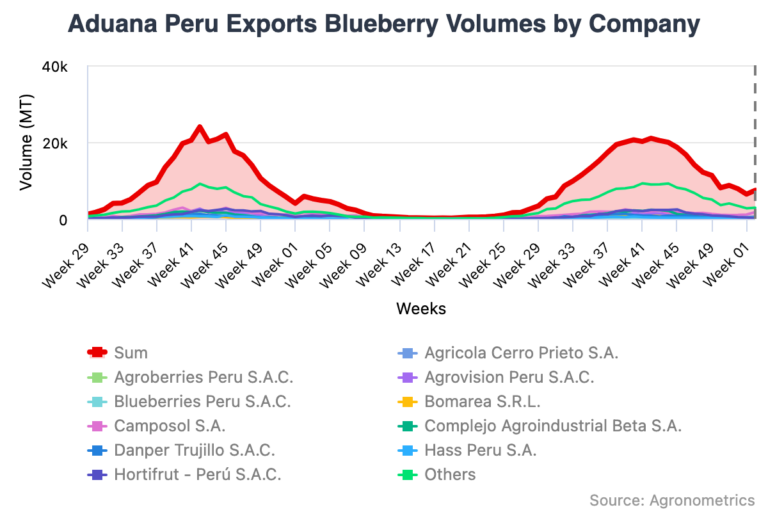

At the business level, Peruvian blueberry participation continued to broaden. In 2025, 207 companies exported the famous berry, compared with around 170 in 2024. While the exporter base expanded, leadership remained relatively concentrated. The top exporters continued to account for a substantial share of total value, though concentration eased slightly, reflecting a gradual deconcentration alongside sustained scale among leading players.

Source: USDA Market News via Agronometrics.

(Agronometrics users can view this chart with live updates here)

The 2025/26 Peruvian blueberry season is marked by strong volume growth, with exports reaching around 340,000 tons by week 1, up roughly 20 percent year over year. While the United States remains the main destination at 47 percent of shipments, exports are becoming more diversified, with Europe growing by about 36 percent and China continuing to expand as a key market.

Production remains concentrated in La Libertad and Lambayeque, but Ica stands out with the fastest growth, driven by improved efficiency, new plantings, and high-yield genetics.

The varietal mix is increasingly aligned with market requirements, led by Ventura, Sekoya Pop, Biloxi, and Mágica, while Peruvian blueberries of the organic variety continue to play a strategic role in premium segments. Overall, the season highlights a shift from volume-driven growth toward greater emphasis on efficiency, market targeting, and execution.

The 2025 campaign delivered record value and volume, but it also conveyed a clear message for the year ahead. As shipments increase, the market adjusts first through price, particularly during peak supply periods. For 2026, the strategic challenge is not simply to grow volume, but to improve placement. Defending arrival windows, maintaining program consistency, and dynamically allocating supply during high-volume weeks will be essential.

Continued expansion of destinations and access routes will also play a critical role, allowing for a more even distribution of exports and reducing pressure on core markets. With the right balance of quality, logistics, and market access, the Peruvian blueberry sector is well-positioned to translate scale into more stable and sustainable returns per 2.2 lbs., even in an increasingly competitive global environment.

Related articles:

Peruvian export boom breaks records, with shipments passing 3 million tons in 2025

Peruvian blueberry sector updates 2025 export outlook with shorter season and volume decrease

Peruvian blueberry exports double as the US and China lead demand