Agronometrics in Charts: Mexico accelerates mango export diversification amid U.S. tariff fears

In this installment of the ‘Agronometrics In Charts’ series, we take a look at Mexican mango export trends. Each week, the series looks at a different horticultural commodity, focusing on a specific origin or topic, visualizing the market factors that are driving change.

Mexico’s mango industry is facing growing pressure to diversify beyond its dominant export market, the United States, amid concerns over trade policy volatility. At the heart of this shift is the Ataúlfo variety.

More than 85% of Mexico’s annual mango production, roughly 2 million tonnes, is typically exported to the U.S., making the northern neighbor a vital buyer. But that dependence now appears to be a liability. News about potential tariffs has revived fears among exporters that mangoes could be the next target, prompting industry leaders to explore new markets in Asia, Europe, and South America.

At the International Mango Symposium held in Mazatlán in late May, producers voiced growing frustration with the uncertainty. The symposium marked a clear pivot in strategy. Conaspromango recently participated in a government-backed trade mission to Europe, targeting countries like France and Spain. While last year all of Mexico’s 80,000 exported mango cartons went to the U.S., leaders now argue that the country’s five main varieties, including Ataúlfo, Kent, Keitt, Tommy Atkins, and Manila, have strong export potential in global markets that demand a wider range of fruit.

Meanwhile, supply conditions remain challenging. Northern states like Sinaloa are struggling through what some scientists describe as the worst drought in 1,200 years, leading to lower yields and smaller fruit. “Climate change is already affecting flowering,” said Dr. Sergio Marquez-Berber, an agronomist from Universidad Autónoma Chapingo. He predicts southern regions like Nayarit will eventually take on more production as water becomes scarcer in the north.

Beyond environmental stress, financial pressure is weighing heavily on smallholders. Nearly 70% of mango producers in Mexico are small family-run farms, many with less than 5 hectares. The result: migration, aging farm labor, and lost harvests. An estimated 54% of Mexico’s mango crop was wasted last season due to a lack of commercial agreements or sales channels.

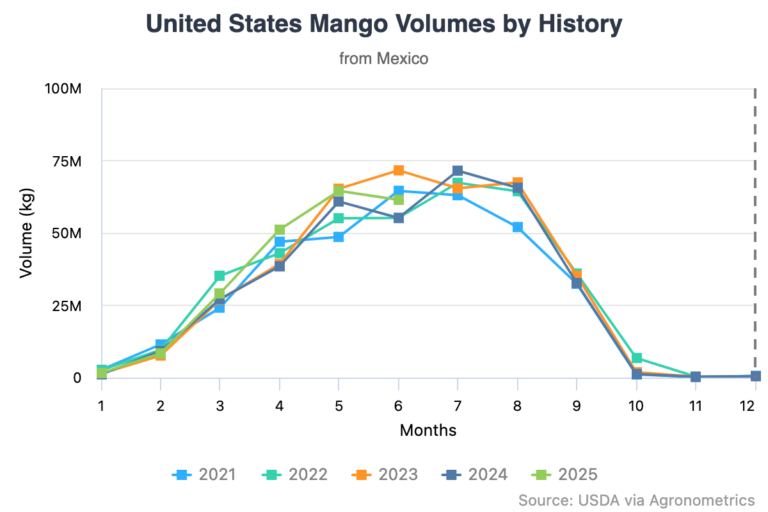

As mango volumes continue flowing into the U.S. this July, with over 65 million boxes already imported this season, pricing remains relatively stable. But behind the numbers is an industry actively working to avoid becoming collateral damage in the next round of trade negotiations.

Source: USDA Market News via Agronometrics.

(Agronometrics users can view this chart with live updates here)

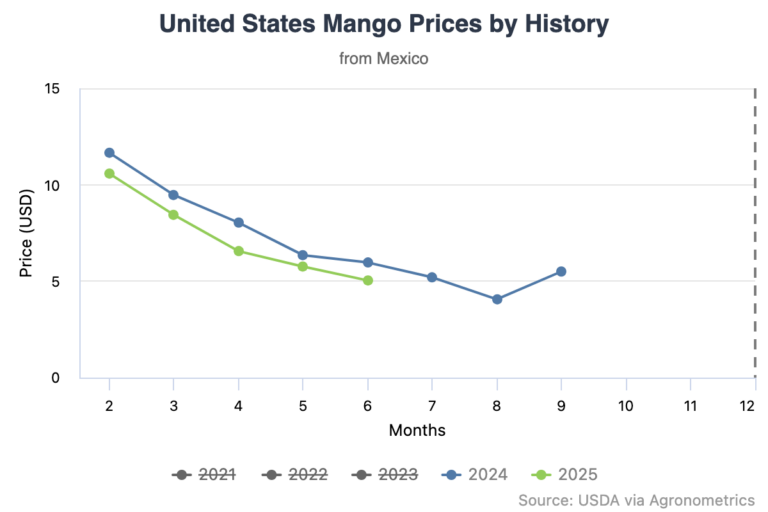

Source: USDA Market News via Agronometrics.

(Agronometrics users can view this chart with live updates here)