Agronometrics in Charts: Peruvian mango supply crunch likely to push up prices this fall

In this installment of the ‘Agronometrics In Charts’ series, we take a look at Peruvian mango trends. Each week, the series looks at a different horticultural commodity, focusing on a specific origin or topic, visualizing the market factors that are driving change.

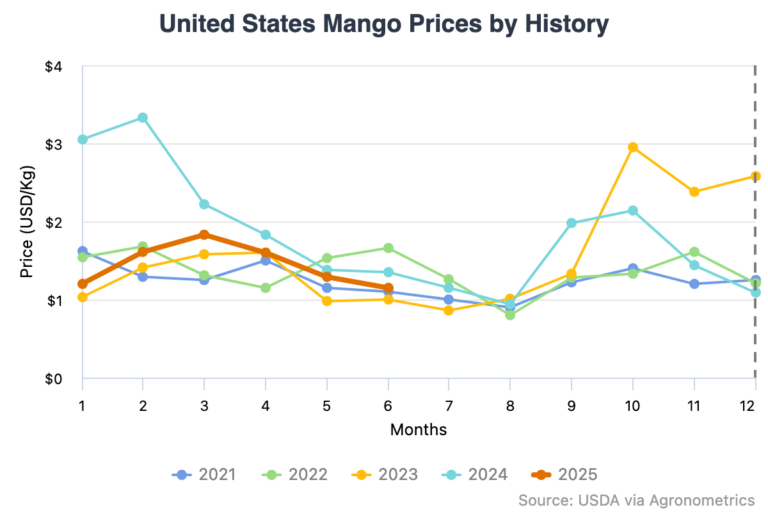

The U.S. mango market is bracing for tighter supply and higher prices this fall, with major exporter Peru reporting a significant drop in production due to alternate bearing cycles and delayed flowering in key growing regions.

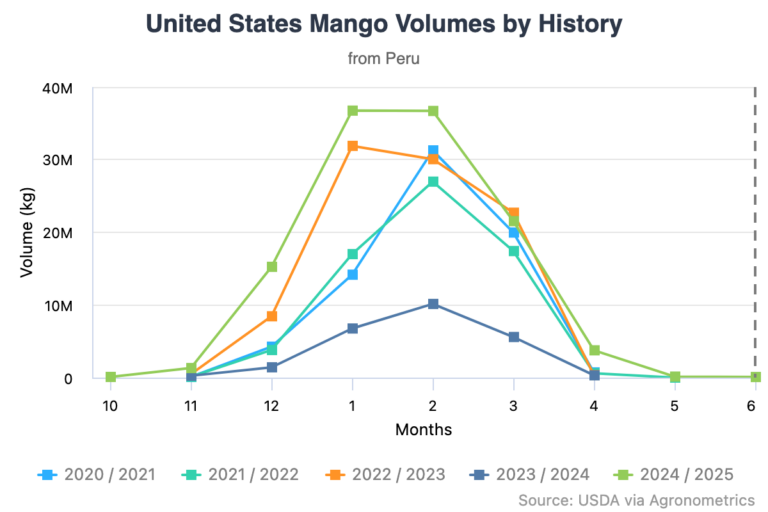

According to the Peruvian Association of Mango Producers (Promango), production this season is expected to hit 450,000 to 500,000 metric tons, down sharply from last year’s 600,000-ton harvest. Much of this decline is tied to alternate bearing, a natural cycle where mango trees swing between high- and low-yield years, as well as climatic irregularities that have thrown off the timing of flowering.

The Peruvian mango season traditionally kicks off in October and peaks in December and January, supplying a large share of U.S. imports during the winter. But this year, flowering delays in Piura and Motupe, two of the country’s most productive mango regions, have pushed harvest timelines back. Promango President Ángel Gamarra noted that fruit from Piura may not appear on the export market until October, with peak volumes likely mid-December through January, weeks behind normal.

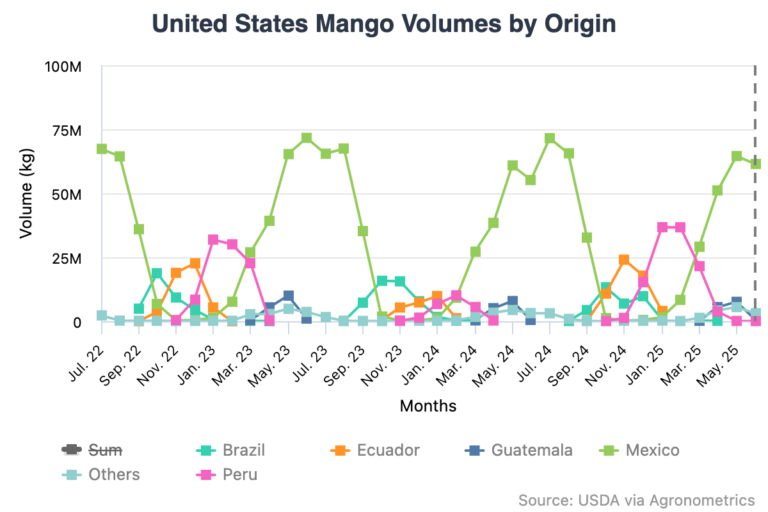

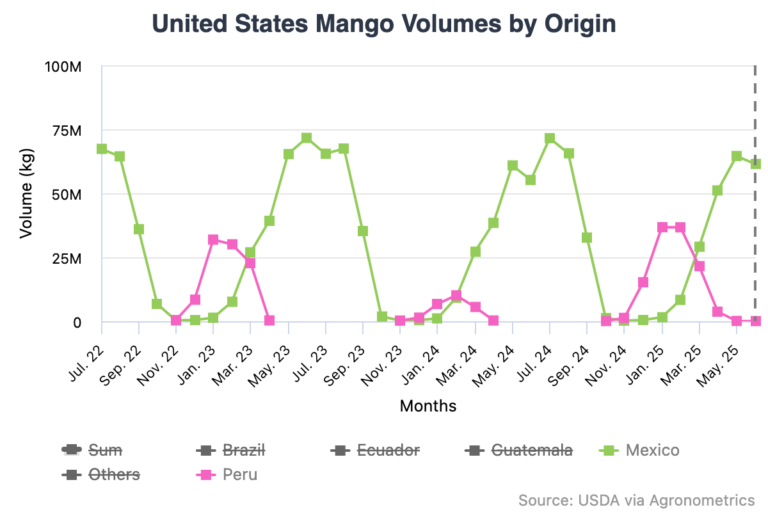

The revised harvest calendar could leave a supply gap in the U.S. from late summer through early fall, when volumes from Mexico wind down and Ecuador and Peru have yet to scale up. This gap may be worsened if forecasted water shortages materialize; low rainfall between July and September could further limit fruit development.

Gamarra outlined three potential outcomes for Peru’s 2025/2026 export season: an optimistic forecast of 12,000 containers, a moderate estimate of 10,000 containers, and a pessimistic scenario of just 8,000 containers. For context, a typical season pushes closer to 13,000 containers. With much riding on flowering conditions in the next few weeks, a clearer forecast is expected by August.

Peru is the second-largest supplier of mangoes to the U.S. after Mexico, especially during the November through March window. Reduced availability will likely push wholesale prices higher, especially for popular varieties like Kent and Ataulfo, which dominate Peruvian exports. Distributors are already hedging. Some importers are looking to Colombia and Brazil to close supply gaps, but neither has the scale or consistency to fully replace Peruvian volumes.

Retailers may feel the pinch during key selling weeks. Last season, mango promotions ramped up in mid-November and held through the New Year, but buyers now report increased landed costs and fewer forward contracts. Consumers can expect noticeable price hikes at retail this fall, especially for organic mangoes and larger fruit, which typically carry higher premiums.

Mango fans in the U.S. should expect a shorter, later, and potentially more expensive season this winter. The final impact will hinge on August flowering developments and rain in Peru.

Source: USDA Market News via Agronometrics.

(Agronometrics users can view this chart with live updates here)

Source: USDA Market News via Agronometrics.

(Agronometrics users can view this chart with live updates here)

Source: USDA Market News via Agronometrics.

(Agronometrics users can view this chart with live updates here)