Agronometrics in Charts: Peru aims for record-breaking blueberry exports in 2025-26

In this installment of the ‘Agronometrics In Charts’ series, we take a look at Peruvian blueberry exports. Each week, the series looks at a different horticultural commodity, focusing on a specific origin or topic, visualizing the market factors that are driving change.

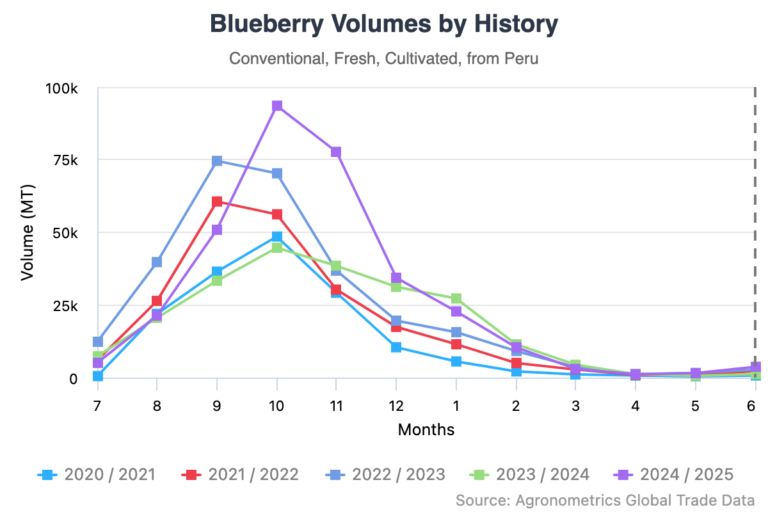

Peru is on track to break its own blueberry export records, with over 400,000 tons expected to ship out during the 2025-26 season, a 25% jump from the previous year. Behind the optimism is a sharp trajectory: since 2016, the Peruvian blueberry sector has grown at an average annual rate of 30% thanks to more planted area, better varieties, and strong demand abroad. But the growth is bringing some strain.

Source: USDA Market News via Agronometrics.

(Agronometrics users can view this chart with live updates here)

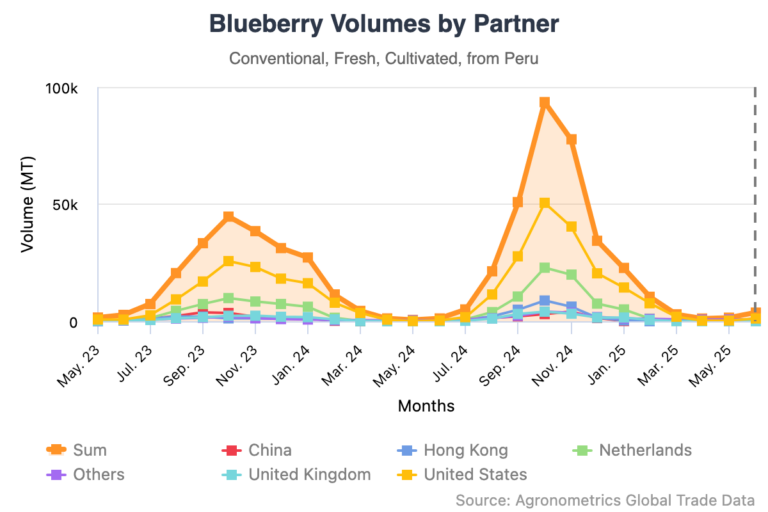

In 2023, El Niño significantly impacted Peru’s blueberry crop and slashed exports by more than 40%. The shortage led to a spike in prices across several markets, with some even doubling. In 2024, things bounced back, but not without hiccups. Many growers delayed pruning to give plants time to recover, which threw off the harvest schedule and packed too much volume into too short a window. This disrupted timing led to heavy volume concentration in just a few weeks, which exposed deep cracks in Peru’s logistics system.

During the peak harvest of 2024, Peru exported over 24 million kilos per week for three weeks straight. That kind of output chokes supply chains. Luis Miguel Vegas, general manager of Proarándanos, cautioned: “If we continue to grow without increasing the harvest period, the system will crash.” The bottlenecks weren’t just about trucks and cold storage; ports, containers, and labor all felt the strain.

To manage the load and stretch the harvest window, Peru is betting big on new blueberry varieties. Traditional workhorses like Ventura and Biloxi fueled early growth, but they’re giving way to more adaptable options like Sekoya Pop and Mágica, which can better withstand climate volatility and stagger their fruiting times. These next-generation varieties now make up about 60% of Peru’s planted blueberry acreage, signaling a fundamental shift in strategy: don’t just grow more, grow smarter.

The U.S. remains Peru’s top buyer, absorbing over 55% of blueberry exports. But eyes are turning east. Thanks to logistics upgrades, including the new Chancay Port, which cuts Asia-bound shipping time by 10 days, exports to China are projected to rise by 6 percentage points. Vegas also highlighted a diversification strategy: moving shipments away from overburdened hubs like the Port of Callao, and steering clear of unstable destinations such as Philadelphia, where recent port strikes have caused disruptions.

Source: USDA Market News via Agronometrics.

(Agronometrics users can view this chart with live updates here)

Peru’s production is growing at 30% annually, but consumption in major markets like the U.S. is increasing by less than 10%. This imbalance could lead to a price squeeze unless new demand is created. To stay competitive, Peru needs to invest heavily in international marketing, expand into new markets, and strengthen its country brand. Without these moves, even high quality fruit won’t hold premium prices in oversupplied markets.

Peru's blueberry boom is a case study in agricultural ambition, rapid growth, innovation, and global reach. But scaling production is only half the game. The real challenge now lies in building the systems, logistics, and demand to support it. As Vegas put it: "We're growing fast. But if we want to stay on top, we need to grow smarter, not just bigger."