Agronometrics in Charts: The Peruvian blueberry boom sets course to Asia

Each week, the series ‘Agronometrics In Charts’ looks at a different horticultural commodity, focusing on a specific origin or topic, and visualizing market factors that are driving change. Check out our entire archive.

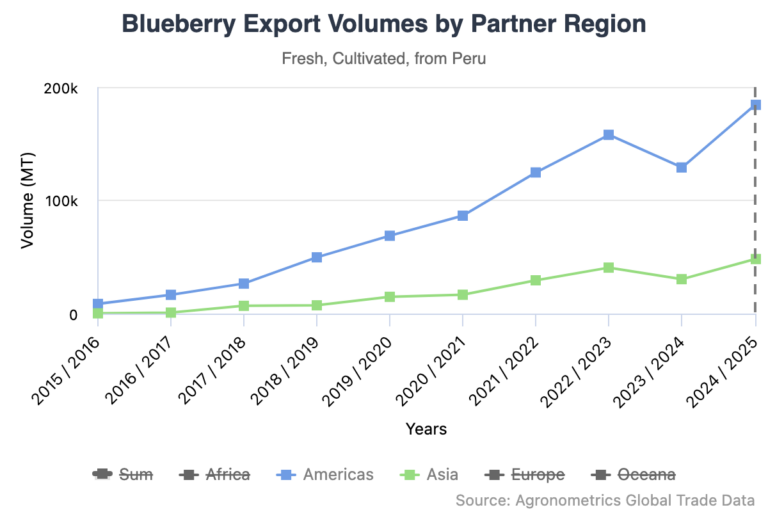

Peru, the world’s largest exporter of blueberries, is rethinking its priorities.

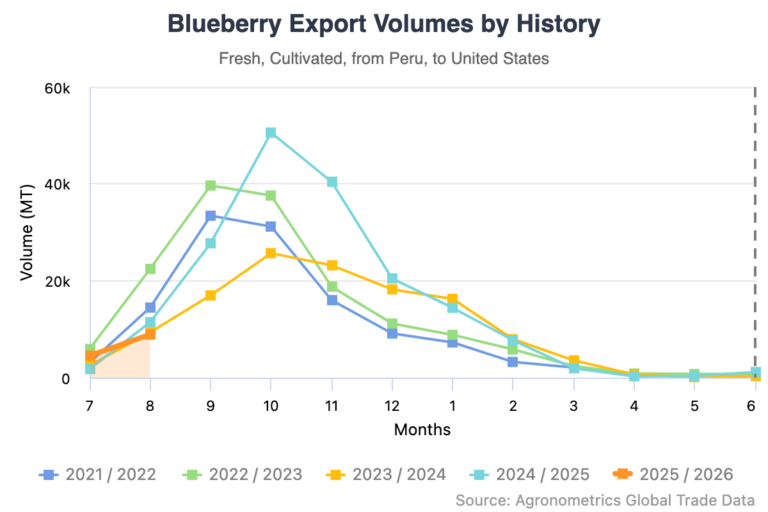

For years, the United States has been the leading destination for the Andean nations’ berries, where their antioxidant reputation has made them a staple among health-conscious consumers. But Ángel Manero, Peru's Minister of Agrarian Development and Irrigation, believes that future growth lies in Asia.

Source: USDA Market News via Agronometrics.

(Agronometrics users can view this chart with live updates here)

Manero returned from recent visits to Japan, Indonesia, and South Korea, convinced that the region could replace the U.S. as Peru’s top produce buyer. The Latin American country has no time to waste, so trade talks are moving quickly.

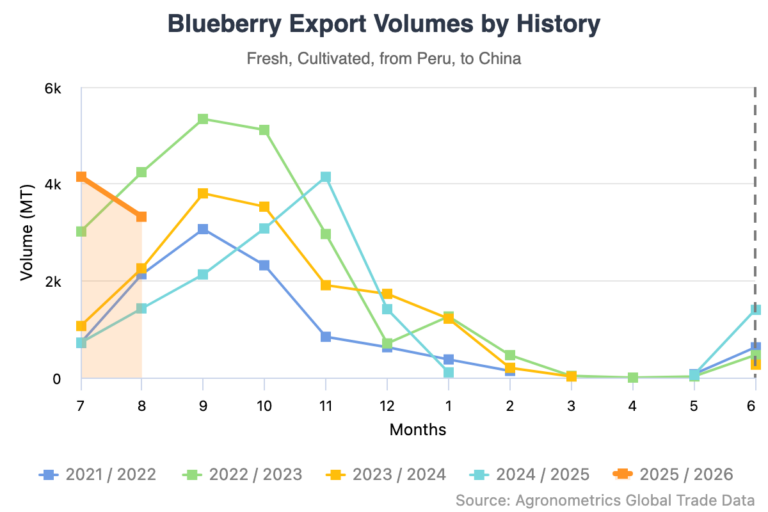

The government is targeting Japan and India as new potential destinations, with exports expected to begin this year pending the approval of health protocols. Indonesia and China are already open for business, while South Korea remains a longer-term objective.

Source: USDA Market News via Agronometrics.

(Agronometrics users can view this chart with live updates here)

“Asia can displace the U.S. because they consume a lot of blueberries,” Manero said. “If everything goes well, this year we can launch Japan and India as new markets.”

Manero has been cautious not to overstate the impact of U.S. agricultural tariffs, but he admits they linger in the background.

“The U.S. gets angry when we talk about Asia, but we believe Peru needs to diversify its supply of agricultural products,” he said. For the Peruvian minister, the issue is less about tariffs and more about avoiding overdependence on one single buyer.

Source: USDA Market News via Agronometrics.

(Agronometrics users can view this chart with live updates here)

The Chinese port in Peru

A key factor driving this shift eastward is the new $1.3 billion port in Chancay, Peru, which was financed and is operated by Chinese companies. Opened last year in the presence of President Xi Jinping, the point of entry is designed to reduce shipping times to Asia, extending the shelf life of perishable goods such as blueberries.

According to Manero, once the facility reaches full capacity in approximately three years, Peru will be able to redirect exports away from the U.S. and Europe, giving the country greater bargaining power.

An expansion worthy of Peruvian blueberries

The Peruvian agricultural industry has already broken records. Peru exported $2.3 billion worth of blueberries in 2024, up 36 percent from the prior year. For the 2025 season, exports are forecasted to grow another 20 percent, an increase officials say can only be sustained if new markets open quickly.

Domestic policy has also tilted in favor of the sector. A bill passed this year in Peru reduced the income tax rate for agribusinesses from nearly 30 to 15 percent. While critics argue that the booming blueberry industry doesn’t need tax breaks, Manero has defended the measure, pointing to the employment generated by agribusiness and its importance to Peru’s export economy.

If the government succeeds, Asia could soon overtake the U.S. as Peru’s largest export market. For Manero, the bet is straightforward: consumer demand in Asia is large and growing, logistics are improving, and Peru’s production capacity is at record levels. The challenge now is to secure access agreements and build reliable supply chains.

“We believe there are great opportunities in Asia,” he says.

Related articles: