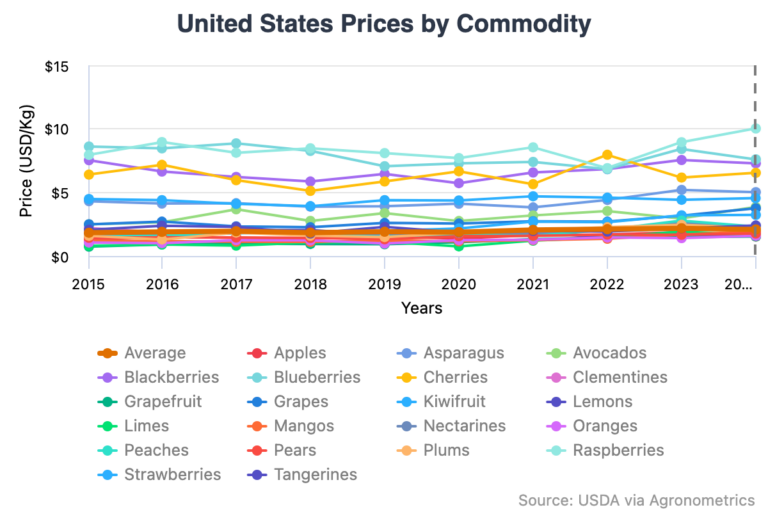

Agronometrics in Charts: Fresh fruit prices hold steady as US tariff pressures mount

Each week, the series ‘Agronometrics In Charts’ looks at a different horticultural commodity, focusing on a specific origin or topic, and visualizing market factors that are driving change. Check out our entire archive.

While headlines around tariffs and inflation tend to focus on steel, tech, and energy, fresh fruit is quietly navigating its own pressure points. A recent Reuters article reveals that the US Producer Prices (PPI) unexpectedly fell in August, driven by softening margins in trade services and a minimal rise in the cost of goods, including food.

Despite widespread import duties, food prices nudged up only 0.1 percent in August. Interestingly, declines in the prices of eggs and fresh fruits helped offset higher costs for beef and coffee, according to the US Bureau of Labor Statistics. That’s a surprising twist, especially as US retailers and importers continue to rely heavily on international fruit during off-seasons.

As noted by Reuters, some economists believe retailers are absorbing tariff costs, at least for now. Stephen Stanley of Santander US Capital Markets explained that many firms have held prices steady through recent quarters, but may soon be forced to pass along increases selectively.

Fresh fruit is unaffected—for now

For fresh fruit, that squeeze could be especially tight. Many large US buyers, including retail chains, importers, and foodservice suppliers, work on tight seasonal margins and depend heavily on volume. Tariffs on fruit imports, particularly from top suppliers such as Peru, Mexico, and Chile, could gradually strain those margins. Yet for now, the fruit aisle appears mostly unaffected, thanks in part to retailers absorbing short-term costs, and possibly, strong competition among global suppliers keeping FOB prices stable.

The lack of inflationary pressure, even with tariffs in place, may also point to weaker domestic demand. With consumer spending shifting, labor market data softening, and more people tightening their grocery budgets, demand elasticity is becoming a real factor.

In the same Reuters report, Christopher Rupkey of FWDBONDS cautioned that inflation at the producer level “barely has a heartbeat.” He suggests that the issue may be less about pricing power and more about slower economic growth. That spells uncertainty for fresh fruit exporters, who may have expected US prices to rise due to a tighter supply, but are instead facing a market more sensitive to demand-side shifts.

As the Federal Reserve prepares to cut interest rates, stakeholders in the fruit industry, from growers to retailers, should watch for signs of shifting consumer behavior and margin compression among retailers and importers, especially those with high exposure to tariffed products.

Even in a high tariff environment, fruit prices are not rising sharply, but that’s not necessarily a sign of market health. It may be the calm before a shift in strategy, sourcing, or pricing dynamics.

Source: USDA Market News via Agronometrics.

(Agronometrics users can view this chart with live updates here)

Related articles: