Agronometrics in Charts: The key factors driving Mexico's horticultural dominance in the US market

Each week, the series ‘Agronometrics In Charts’ looks at a different horticultural commodity, focusing on a specific origin or topic, and visualizing market factors that are driving change. Check out our entire archive.

Written by Colin Fain, from Agronometrics.

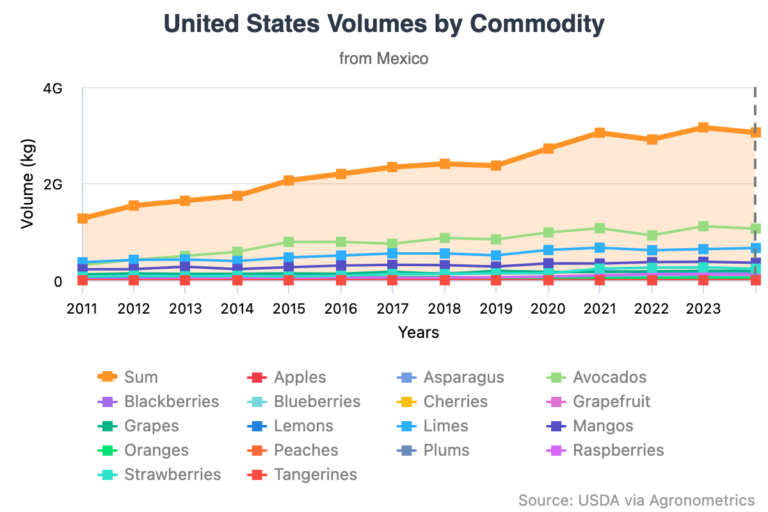

Mexico remains the primary supplier of fresh horticultural products to the United States.

According to a recent report published by the USDA’s Economic Research Service, in 2023, the US imported $20.2 billion worth of fresh horticultural commodities from Mexico, accounting for 61 percent of total imports. Canada followed at $5.9 billion (18 percent) and Chile at $1.8 billion (5 percent). Other suppliers included Peru, Guatemala, Costa Rica, and Honduras.

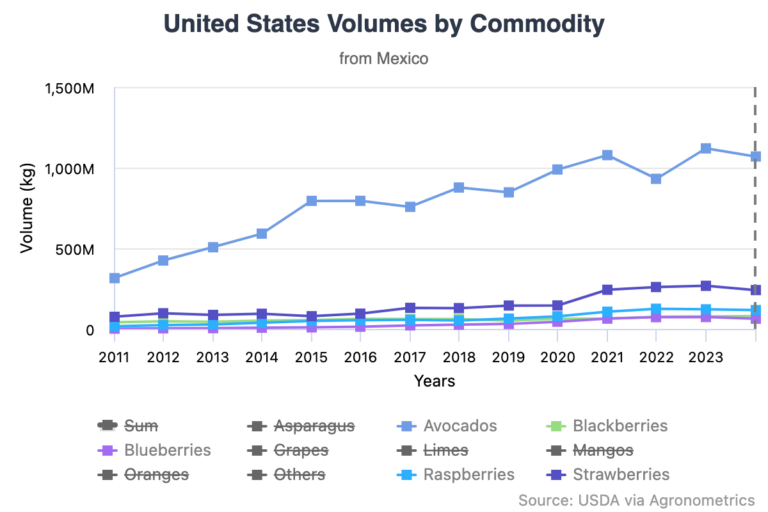

In 2023, imports for berries totaled $4.3 billion. Blueberries, raspberries, and blackberries together represented more than three-quarters of berry imports, with strawberries accounting for the remainder. Avocados reached $3.1 billion, making them one of the most valuable single products.

Source: USDA Market News via Agronometrics.

(Agronometrics users can view this chart with live updates here)

The multifactorial US-Mexico horticultural relationship

Several factors have driven the Mexican horticultural sector’s long-standing focus on the US market.

Mexicoʼs proximity, its favorable climate, trade liberalization, and regulatory coordination, are the pillars supporting this relationship.

Other factors playing an important role are Mexican exporters' efforts to meet US food safety standards, the greater affordability of farm labor in Mexico, the participation of US agribusiness in Mexicoʼs horticultural sector, as well as cross-country differences in population and per capita income.

Source: USDA Market News via Agronometrics.

(Agronometrics users can view this chart with live updates here)

The immediate proximity of the two countries reduces the costs of transportation between Mexicoʼs horticultural growers and specific destinations within the United States.

Mexico and the United States share a land border of about 1,954 miles, and the highway systems of the two countries are used to transport horticultural products from Mexican farms and packing facilities to destination markets in the United States.

Seasonality continues to influence the trade relationship. Shipments of Mexican vegetables peak in winter and spring, aligning with lower US domestic production. For berries, the Mexican season complements US output, especially in early spring. Avocado imports also show strong peaks, closely tied to demand cycles in the United States.

Overall, the share of Mexico in US horticultural imports has expanded over the past decade. Between 2014 and 2023, Mexico's share of US fresh fruit and vegetable imports rose from 53 percent to 61 percent.

This growth highlights the country's role in supplying key products such as avocados, berries, and tomatoes, supported by logistics advantages and production scale.