Agronometrics in Charts: The keys behind Peru's unprecedented 2025-26 table grape market expansion

Each week, the series ‘Agronometrics In Charts’ looks at a different horticultural commodity, focusing on a specific origin or topic, and visualizing market factors that are driving change. Check out our entire archive.

Peru is on track to close 2025 with about $1.9 billion in table grape exports, a figure that would reinforce the country’s position as a global leader in an increasingly competitive market, according to Fresh Fruit Peru.

Between January and October 2025, Peru shipped $894 million in grapes, equal to 351,152 tons. That marks a 29 percent jump in value and a 56 percent rise in volume compared to the same period in 2024.

This growth in the grape category comes despite a challenging landscape shaped by overlapping supply from China, Chile, Italy, and South Africa, and a consumer base that is more selective about grape variety and quality.

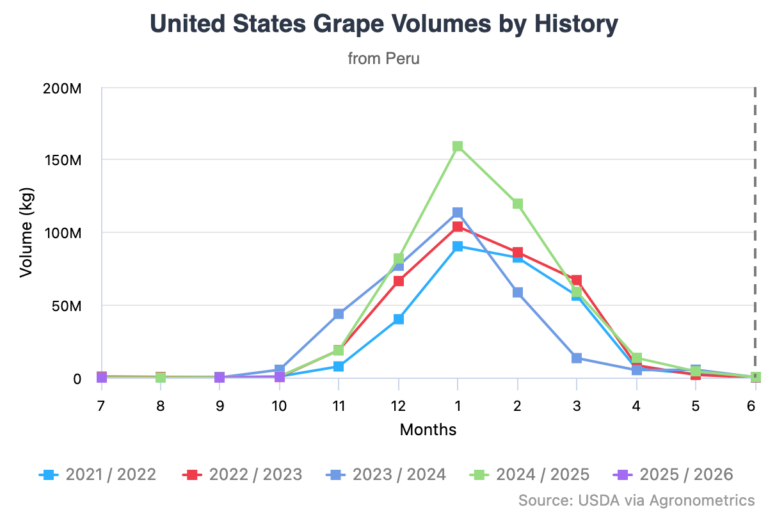

Source: USDA Market News via Agronometrics.

(Agronometrics users can view this chart with live updates here)

Planning is critical to Peru's table grapes

Peru’s grape calendar runs in two phases. From January to March, the last volumes from the south are shipped. From October onward, the north begins the new harvest.

The early months of 2025 delivered strong results. Exports from January to March reached $598 million and 243,836 tons, nearly doubling year-over-year volume. This is due to high arrival quality and a focus on premium seedless grapes, even as prices fell 25 percent due to a larger global supply.

The October restart brought solid performance from Piura, Lambayeque, and La Libertad, all of which supply retail programs that prioritize consistent size and firmness. The month ended with $219 million in sales and 77,444 tons, with value slipping 3% and volume rising 2%.

Recent improvements in harvest planning and staggered planting are smoothing out the two peaks, increasing margins, and allowing exporters to allocate premium varieties to high-value niches while moving standard varieties at competitive retail prices.

The country’s strong cold-packing capacity and reliable logistics continue to support growth, and Fresh Fruit projects that 2025 will be another record year.

Varietal shift and market diversification

Peru’s rise is tied to a decisive shift away from Red Globe and toward patented seedless varieties.

Today, around 75 percent of exports come from these newer grapes. Sweet Globe leads with 27 percent, followed by Autumn Crisp at 17 percent, Allison at 10 percent, and Sweet Celebration at 4 percent. Red Globe still holds a niche at 12 percent, especially in Asia.

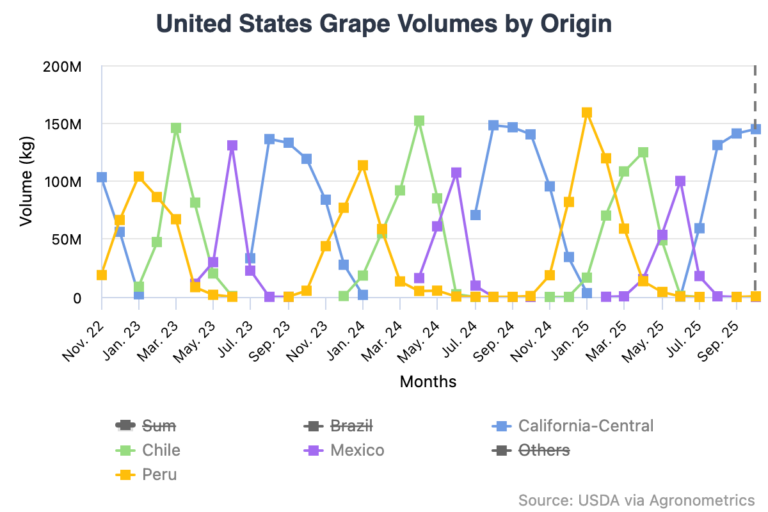

Between January and October 2025, Peru reached 56 destinations, up from 52 last year. The United States remained the top market at $411 million and 165,934 tons.

Looking ahead, Fresh Fruit expects the 2025–2026 campaign to finish between 740,000 and 780,000 tons and between $1.85 and 1.95 billion.

Source: USDA Market News via Agronometrics.

(Agronometrics users can view this chart with live updates here)

Related stories

Peruvian table grape season gaining momentum

Peru's table grape exports soar to $1.9 billion, dominating global market

New varieties drive Chilean table grape industry shift, exports forecast to decline