Hass avocado Q3 report: Independence Day soars, Labor Day unit Growth offsets price drop

United States retailers sold more Hass avocados during the key summer holidays in the third quarter of 2025 than a year earlier. This is the main finding of a new report published by the Hass Avocado Board (HAB) and developed with data from market insights broker Circana.

The strong performance, the document says, was led by Independence Day, which pushed unit sales to a four-year high.

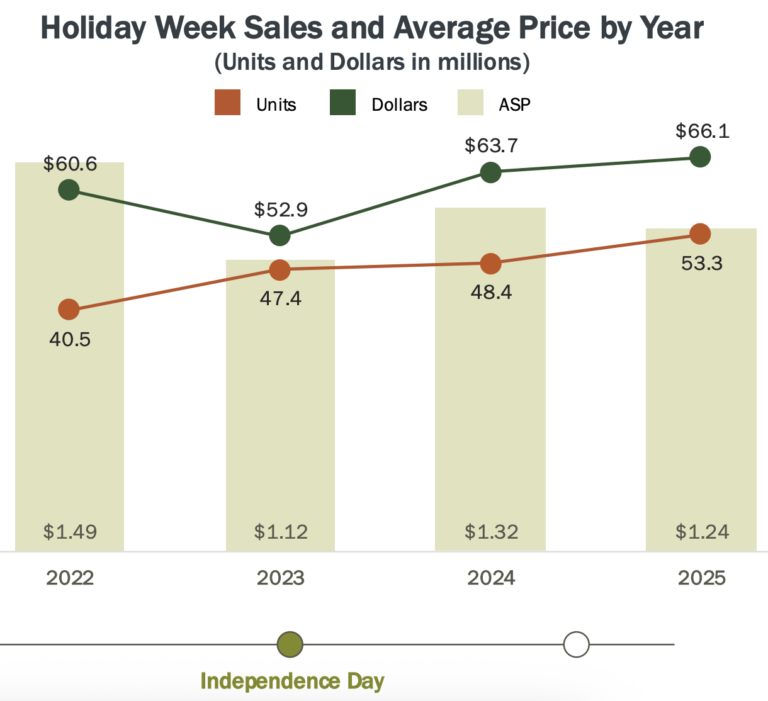

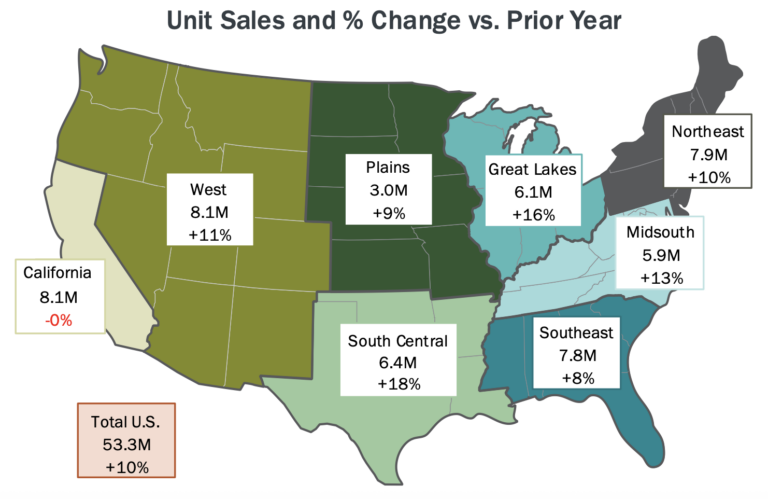

The 4th of July delivered the quarter’s highest volume, with 53.3 million units sold, representing an uptick of ten percent year-on-year. Dollar sales rose four percent to $66.1 million, despite a six percent decline in average selling price to $1.24 per unit.

The gains made Independence Day the second-strongest holiday of 2025 for avocado unit growth, trailing only Memorial Day, which posted a 13 percent increase.

Promotions fuel Hass avocado Q3 volume

Promotional activity increased during the quarter and generated a combined lift of 6.6 million pounds of incremental Hass avocado volume across Independence Day and Labor Day, the report notes.

Total dollar sales increased by $2.5 million year-over-year, with the West region accounting for most of that gain. Average selling prices varied, ranging from $1.08 per unit in the South Central region, down four percent, to $1.47 per unit in the West, up one percent.

Bagged avocados played a significant role in holiday performance. Bags represented 30 percent of total unit sales during Independence Day week and led overall growth, increasing 29 percent from the prior year and adding 3.6 million incremental units.

Small avocados accounted for 48 percent of total unit sales, contributing an additional 2.2 million units.

Labor Day adds units, loses dollars

Labor Day also posted higher unit movement, with shoppers purchasing 48.3 million avocados, up six percent or 2.8 million incremental units, compared with 2024. However, lower pricing pressured dollar results.

Holiday-week dollar sales fell seven percent to $56 million as the average selling price dropped 12 percent year-on-year to $1.16 per unit, the lowest among 2025 holidays to date.

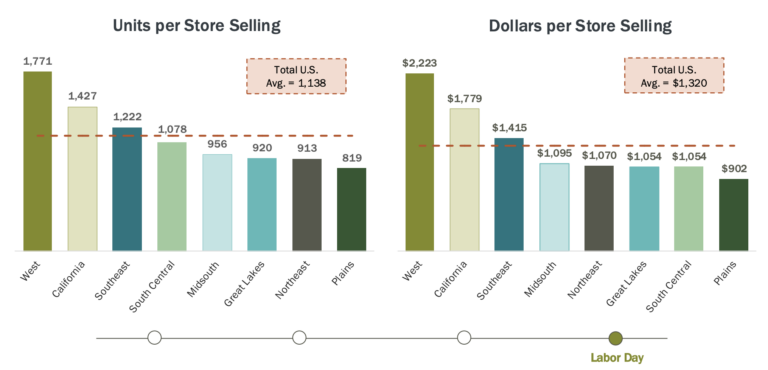

Regional pricing during Labor Day ranged from $0.98 per unit in the South Central region, down 17 percent, to $1.26 per unit in the West, down 14 percent. Unit growth was driven primarily by the Southeast region, followed by the Great Lakes, while overall dollar sales declined by $3.9 million versus last year.

All Hass avocado PLUs contributed to Labor Day unit growth. Extra-large avocados recorded the highest growth rate at 34 percent compared with 2024. Bagged avocados grew six percent and accounted for more than one-quarter of retail unit sales during the holiday.

Related stories

Avocados From Mexico forecasts record 2.5 billion pounds of US imports for 2025-2026 season

US avocado imports dip for the holidays, but the season still bears fruit