Agronometrics in Charts: Labor costs squeeze US fruit growers, threatening profit margins in 2026

Each week, the series ‘Agronometrics In Charts’ looks at a different horticultural commodity, focusing on a specific origin or topic, and visualizing trade market factors that are driving change. Check out our entire archive.

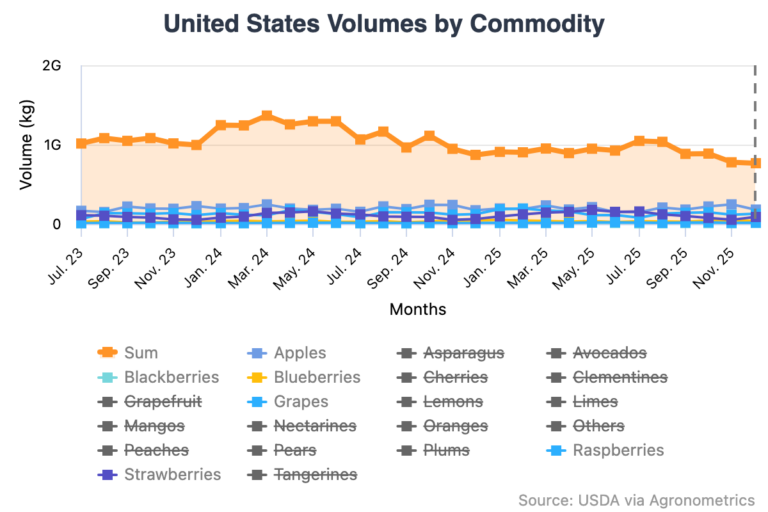

Most US fruit growers reported steady to slightly above-average yields in 2025. Production held up well across regions and commodities. That stability, however, masks growing pressure on the business side of fruit farming. Labor costs, weather volatility, and lingering trade uncertainty continue to weigh heavily on profitability.

“Specialty crop producers are dealing with persistent challenges tied to labor, policy, and trade,” said Sarah Gonzalez of the International Fresh Produce Association. Tariffs, workforce shortages, and rising input costs remain top concerns for growers heading into 2026.

Berry growers benefited from strong consumer demand again last year, but returns tightened as costs rose. The blueberry sector, spanning the US and major export competitors, continues to push for higher consistency and quality to stay competitive. Grape and nut producers faced uneven quality due to weather and water limitations, though demand remains firm, helping support grower confidence. Apples continue to serve as the backbone of the US fruit industry.

“US apple production in 2025 was solid and reliable,” said Lynsee Gibbons of the US Apple Association. Early estimates put the crop slightly above average, though late-season heat in the Northwest and drought in parts of the Northeast reduced final expectations. As harvest wrapped up, it became clear total production would fall somewhat below initial projections, reinforcing how sensitive outcomes have become to weather shifts.

Source: USDA Market News via Agronometrics. (Agronometrics users can view this chart with live updates here)

Even with reasonable yields, labor remains the single biggest challenge for fruit producers.

“High labor and input costs, paired with softer pricing in some markets, are squeezing margins for US fruit growers,” Gibbons said.

Labor alone accounts for more than 60 percent of apple production costs. Wage rates have climbed sharply over the past five years, raising concerns that more family-scale farms may be forced to consolidate or exit the industry if relief does not materialize.

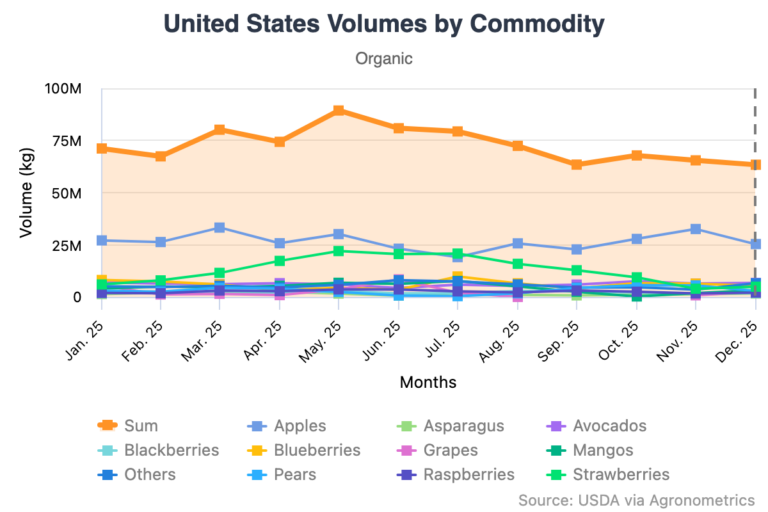

Organic fruit continues to outperform the broader market.

“Organic fresh produce reached $21.5 billion in sales in 2024, up more than 5 percent from the year before,” said Tom Chapman of the Organic Trade Association.

Growth is expected to continue into 2026. Organic growers, however, feel labor pressures acutely due to the hands-on nature of production, making cost control an ongoing challenge even as demand remains strong.

Source: USDA Market News via Agronometrics. (Agronometrics users can view this chart with live updates here)

Trade uncertainty continues to shape planning decisions, particularly for apples.

“Losing market access can happen quickly, and rebuilding it takes time,” Gibbons said, pointing to the lasting effects of recent tariff disputes.

Weather volatility adds another layer of risk. Drought, heat, and unpredictable growing conditions are now routine concerns across US fruit regions, underscoring the need for resilience in both production and planning.

As the industry moves into 2026, US fruit growers are focused on protecting margins while meeting steady consumer demand for healthy, fresh products.

“The opportunity is there,” Gonzalez said, “but success will depend on managing costs, navigating policy and trade issues, and keeping fruit accessible to everyday consumers.” The challenge ahead is less about producing fruit and more about sustaining the businesses that grow it.

Related articles

Rising costs and inventory shifts pressure US apple growers

US fruit exports struggle in the Philippines as regional rivals capitalize on zero tariffs