Agronometrics in Charts: US apple growers eye global market opportunities

Each week, the series ‘Agronometrics In Charts’ looks at a different horticultural commodity, focusing on a specific origin or topic, and visualizing market factors that are driving change. Check out our entire archive.

The US apple industry is projecting another high-performing year, with production for 2025-26 forecast at 11.7 billion pounds (278.5 million bushels), according to the US Apple Association’s Industry Outlook 2025. The figure is up 1.3 percent from last year and 3.6 percent above the five-year average.

Gala remains the leading variety at 47 million bushels, followed by Red Delicious at 39 million, Honeycrisp at 34 million, Granny Smith at 32 million, and Fuji at 25 million. Varieties such as Honeycrisp, Granny Smith, Cosmic Crisp, and Pink Lady are on the rise, while Gala, Fuji, and Rome are trending downward.

Exports dipped 5 percent in 2024-25 to 44 million bushels, but the US retained a strong trade balance with net exports valued at nearly $900 million. USApple notes that sustaining and expanding exports is crucial with another large crop on the way, pointing to opportunities in South Korea and Japan as well as growth potential in India, Taiwan, and Thailand.

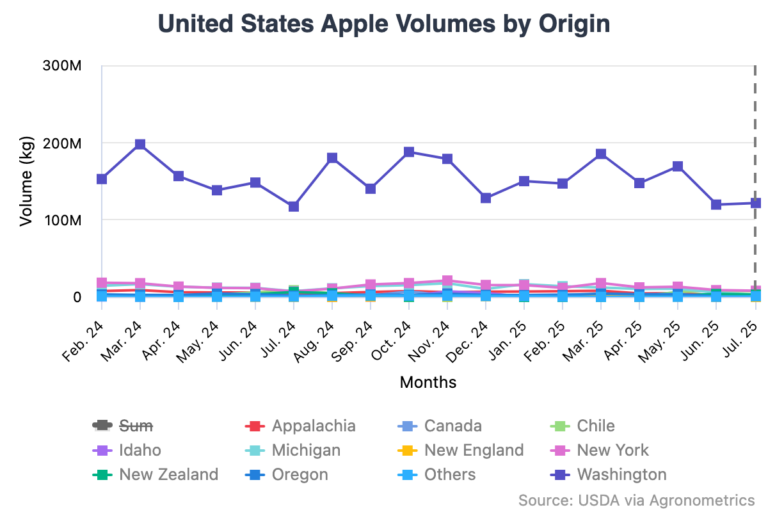

State-level production shows Washington leading with more than 180 million bushels valued at $2.3 billion, up 1 percent. New York is forecast at 30.5 million, nearly steady, while Michigan is up 10 percent to 30 million. Pennsylvania rose modestly to 10.5 million, Oregon surged 40 percent to 3.9 million, and Virginia fell sharply by 50 percent to 2.75 million.

Globally, apples remain a major crop, with production above 5 billion bushels. China dominates with 51 percent of the supply, while the US holds 5.3 percent. With China’s crop down 100 million bushels and Turkey’s reduced by 40 percent, US growers see opportunities to regain market share, particularly in India, where Turkiye has historically supplied heavily.

The 2025-26 outlook confirms a robust crop, positioning US growers to meet strong domestic demand while capturing new global opportunities at a time when competitors face production setbacks.