Agronometrics in Charts: Stocked by the world—how foreign imports power the US fresh fruit market

Each week, the series ‘Agronometrics In Charts’ looks at a different horticultural commodity, focusing on a specific origin or topic, and visualizing market factors that are driving change. Check out our entire archive.

Written by Thomas Grandperrin, from Agronometrics.

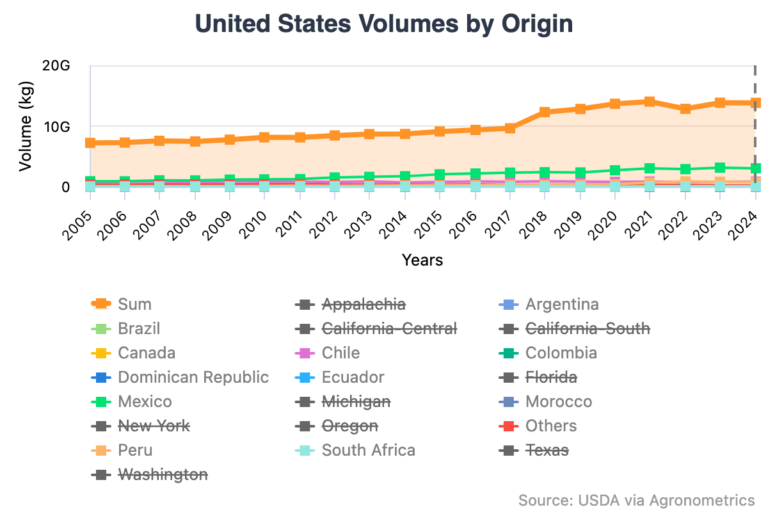

In 2024, the United States imported approximately $33 billion in fresh fruit, compared to just $16 billion it exported, a clear indication that foreign supply has become fundamental to everyday consumption.

In the 1980s, only 30 percent of fresh fruit on US shelves came from abroad. Today, that figure is approaching 60 percent, with vegetables showing a similar climb. What was once tied to seasons is now available year-round: berries in winter, grapes in fall, asparagus in spring, and avocados in every grocery cart, every week.

This year-round appetite for fresh fruit has elevated international suppliers into core partners in the US food system.

Survival of the fittest: North and South American powerhouses compete for a seat

While Canada and Mexico still dominate import flows at about 42 percent, South American producers continue to gain strategic ground. Brazil reached $5.7 billion in 2024, Peru followed with $4.5 billion, Colombia with $4.2 billion, and Chile closed the year at $2.9 billion.

Competition in the fresh fruit and vegetable market is shaped less by price and more by two decisive forces: timing and standards.

Those who succeed are suppliers who can deliver when others cannot and meet the most demanding requirements for safety, traceability, sustainability, and cold-chain reliability.

American consumers see the end product on the shelf, and import programs are designed to ensure that fresh fruit and vegetables reach them without fluctuation in taste, condition, or volume.

Finding balance

Despite this opportunity, the scale of US consumption also introduces risk. Because the market absorbs such a large share of global fresh produce exports, it's easy for suppliers to become overly dependent on it.

The challenge is to maintain strong positioning in the US while continuing to open alternative channels in regions such as Asia and the Middle East, where demand and logistical capacity are skyrocketing.

Fresh fruit demand is alive and well

Future gains for suppliers will come less from volume expansion and more from segmentation.

With fresh fruit imports nearing $33 billion and vegetable imports exceeding $21 billion, the true margin lies in supplying differentiated varieties, origin-driven products, organics, residue-controlled lines, and ready-to-eat or pre-conditioned formats that deliver convenience and identity.

In an import market defined by consistency rather than seasonality, the suppliers who move beyond commodity status and into curated, traceable, premium niches will capture the strongest long-term advantage.

Source: USDA Market News via Agronometrics.

(Agronometrics users can view this chart with live updates here)

Related stories

As Japan’s production declines, US cherry imports come to the rescue

Shifting vines: How China’s appetite is reshaping the grape market

Chilean table grape forecast: Varietal renewal drives exports despite slight market decline