Agronometrics in Charts: Argentine agroexports hit $42.2B export surge

Each week, the series ‘Agronometrics In Charts’ looks at a different horticultural commodity, focusing on a specific origin or topic, and visualizing trade market factors that are driving change. Check out our entire archive.

Argentine agroexports reached $42.213 billion in 2025, up 7.6 percent from the previous year.

While broader recovery was driven mainly by grains and oilseeds, the fruit segment delivered selective but meaningful gains, reinforcing its role as a complementary, rather than dominant pillar of the country’s export portfolio.

Among fresh fruit categories, lemons remained Argentina’s flagship product.

Argentine agroexports snapshot

Lemon exports increased 16 percent year over year to $510 million, consolidating Argentina’s position as a key global citrus supplier. The category continues to anchor the country’s fruit identity abroad, particularly in processed and fresh citrus markets.

Temperate fruits also maintained a steady presence. Pears totaled $282 million, while apples reached $104 million in 2025. Though smaller in scale compared to field crops, these categories reflect Argentina’s established orchard production base and longstanding export relationships.

Despite these fruit-specific movements, the structure of Argentine agroexports remains largely commodity-led. Soy, corn, and wheat continue to account for the majority of value, meaning overall performance is still closely tied to global grain dynamics rather than fresh produce diversification.

In 2025, Argentina’s fruit exports showed resilience and incremental growth. However, their relative weight within the national export mix remains limited. The key strategic question for the coming years is whether fruit categories can gradually expand their share and add balance to an export model still strongly anchored in bulk commodities.

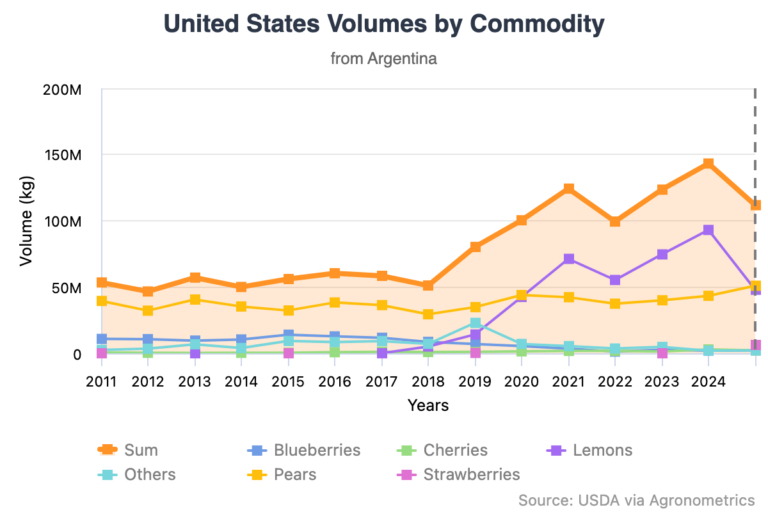

Source: USDA Market News via Agronometrics. (Agronometrics users can view this chart with live updates here)

*All images are referential.

Related articles

California pear growers demand action against 125 percent import surge from Argentina

How Milei's policies and global trends are reshaping Argentine agroexports