Agronometrics in Charts: Sizable California cherries expected

In this installment of the ‘Agronometrics In Charts’ series, Sarah Ilyas evaluates the state of the California cherry market. Each week the series looks at a different horticultural commodity, focusing on a specific origin or topic visualizing the market factors that are driving change.

The 3rd Global Cherry Summit was held on Tuesday, April 19th, 2022 in Chile and brought together industry professionals from all over the world, the agenda of the summit was to find common ground to overcome successive challenging seasons.

Meanwhile Joe Cataldo, head of field operations and grower relations for Lodi, CA-based Delta Packing Co. discussed his projections for the upcoming California season. “We’ve had a very interesting spring. We had some extreme frost a few weeks back and looking at the way the crop is setting up throughout the state, I think it will be on the lighter side, last year we had a 10 million box crop even with the heat and labor issues. Between all of that, we could have packed 12-13 million boxes. But there’s going to be plenty of good sized marketable fruit this season weather permitting and hopefully we can make it until the end of June.” he said in an industry publication.

As for the Pacific Northwest, Desmond O’Rourke, founder and chief executive officer of Belrose outlined that sweet cherry demand is becoming less elastic at FOB level than at retail. “So we’re getting to the point where an increase in shipments will start reducing prices unless we expand the promotion for Pacific Northwest sweet cherries,” he added.

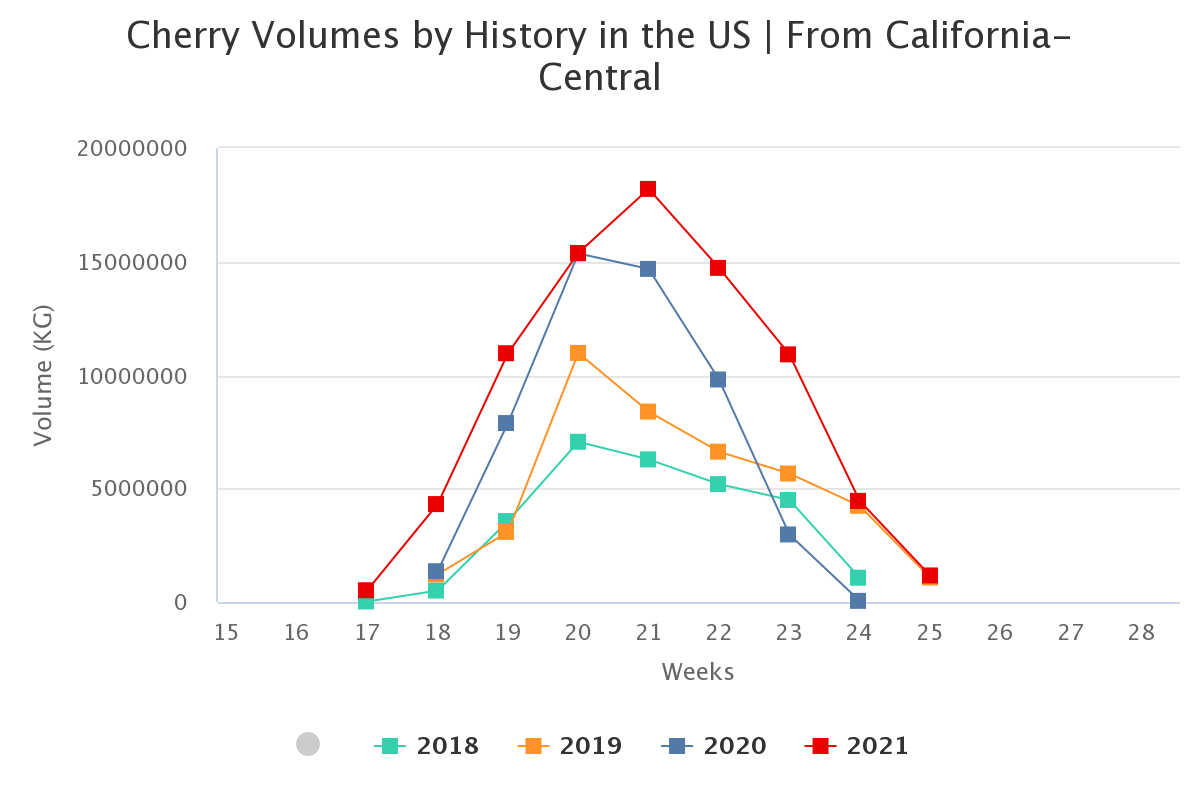

(Source: USDA Market News via Agronometrics. Agronometrics users can view this chart with live updates here)

Supply chain issues have been plaguing the market for two years in a row and are not expected to clear up any time soon. Many fresh produce suppliers are taking a strategic approach to minimize potential supply chain challenges by preplanning all areas of logistics.

Some companies have resorted to ordering packaging and materials months in advance of the season, far before they have a valuation for the upcoming season.

On the other hand, recent spikes in fuel costs are expected to add to the transportation woes during the season. Retailers are focusing on effective marketing campaigns such as building large displays that incorporate branded boxes at the front of the produce section.

The Flavor Tree Fruit Company for instance is using Sequoia- and Suntree-branded handled-pouch cherry bags to to highlight their premium cherries.

Cristián Tagle of the Asoex Cherry Committee gave a simple but concise synopsis of the past year during his opening remarks that seemed to resonate with the audience: “What a season, what a season we have had, I can’t remember one that was more difficult.” He ended the conference on a more sanguine note, claiming: “together, all of us together can contribute to a solution to the obstacles which we are confronting.

(Source: USDA Market News via Agronometrics. Agronometrics users can view this chart with live updates here)

In our ‘In Charts’ series, we work to tell some of the stories that are moving the industry. Feel free to take a look at the other articles by clicking here.

All pricing for domestic US produce represents the spot market at Shipping Point (i.e. packing house/climate controlled warehouse, etc.). For imported fruit, the pricing data represents the spot market at Port of Entry.

You can keep track of the markets daily through Agronometrics, a data visualization tool built to help the industry make sense of the huge amounts of data that professionals need to access to make informed decisions. If you found the information and the charts from this article useful, feel free to visit us at www.agronometrics.com where you can easily access these same graphs, or explore the other 21 commodities we currently track.