Agronometrics in Charts: Chilean avocado production holds steady following record year

Each week, the series ‘Agronometrics In Charts’ looks at a different horticultural commodity, focusing on a specific origin or topic, and visualizing market factors that are driving change. Check out our entire archive.

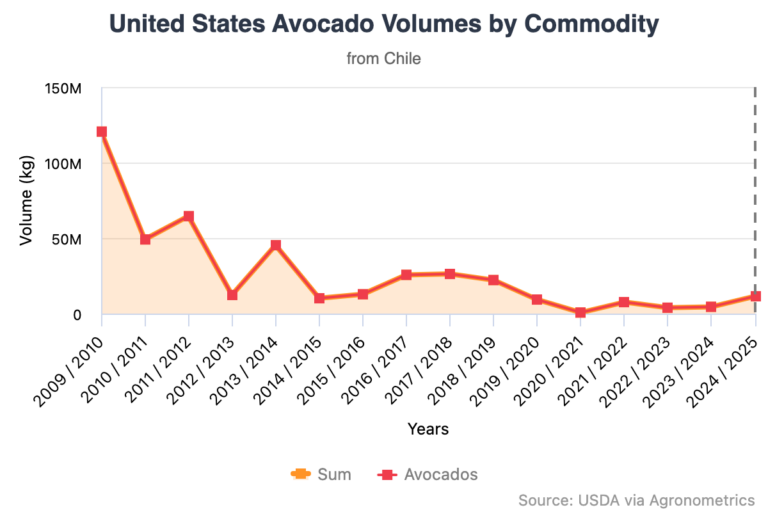

In the 2024/25 season, Chilean avocado production hit 240,000 tons, making it the biggest crop of the last 15 years and the second-biggest ever.

According to data provided by the Chilean Avocado Committee, only the 290,000-ton crop of the 2009-10 season topped the season’s results.

“These results are excellent news for the sector and reflect the economic impact of our industry, which generates more than $700 million annually,” said Francisco Contardo, executive director of the Chilean Avocado Committee.

The Chilean avocado sector expects to sustain its momentum in the 2025-2026 season, with an estimated production of 240,000 tons, a similar volume to that of the previous year.

The secret formula of the Chilean avocado industry

The good performance is due to favorable weather conditions, the adoption of new technologies, and more effective agronomic management. These factors have enabled the industry to stay competitive in a demanding international context.

"Maintaining harvest levels similar to those of last year, which was a very good season, is excellent news," said Contardo. He also pointed out that the growth is supported by a stable surface area of over 74,000 acres and a sustainability roadmap from 2020, aligned with the United Nations' Agenda of 2030.

Last season, 57 percent of the fruit was destined for international markets and 43 percent for domestic consumption. If this proportion is maintained, projections indicate 136,000 to 138,000 tons will be exported, and approximately 103,000 to 104,000 tons will be allocated for the domestic market.

The main market for Chilean avocados is Europe, with Latin America coming in second.

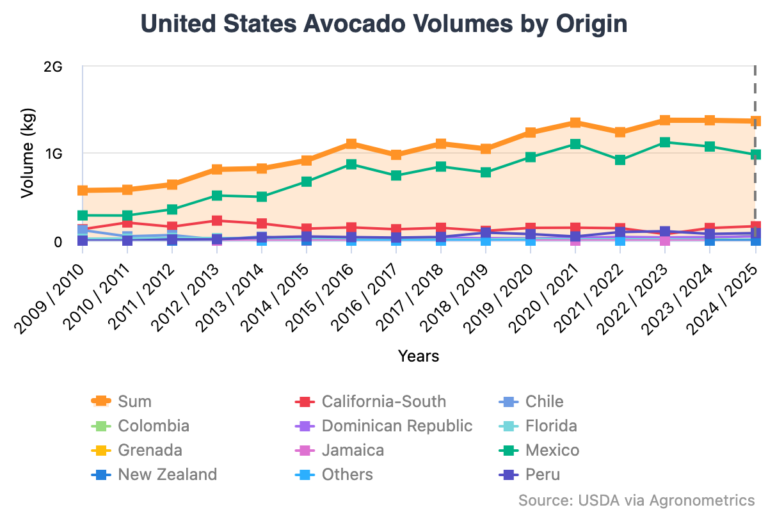

The United States, the Netherlands, the United Kingdom, Spain, China, and Argentina are among the approximately 40 nations that now import Chilean fruit. Standards for food safety, quality, and traceability support this, making Chile a trusted brand in major markets.

In the 2024-25 season, Chile exported 11,476 metric tons of avocados to the US market.

Source: USDA Market News via Agronometrics.

(Agronometrics users can view this chart with live updates here)

The integration of technology in irrigation, orchard management, and post-harvest processes remains a key factor for the sector's competitiveness amid logistical costs and international competition challenges.

Sustainability as a non-negotiable

According to the Chilean Avocado Committee, sustainability is now a prerequisite for market access and can be attained by ethical and responsible environmental practices, close community relationships, and certifications that emphasize the value of origin.

Contardo says the stability of the cultivated land and accumulated technical expertise have enabled the development of a strong production base.

The leader recognized pressing issues like modifying commercial windows, optimizing product size and condition upon delivery, and protecting margins through enhanced risk management and logistics.

Source: USDA Market News via Agronometrics.

(Agronometrics users can view this chart with live updates here)

Related stories