Agronometrics in Charts: Massive surge in Peruvian mango exports sinks prices

Each week, the series ‘Agronometrics In Charts’ looks at a different horticultural commodity, focusing on a specific origin or topic, and visualizing market factors that are driving change. Check out our entire archive.

Peruvian mango exports maintained a robust performance during the first ten months of 2025, driven by strong international demand and significantly higher shipment volumes, according to Fresh Fruit Peru. Between January and October, the country exported $399.5 million worth of mangoes, an impressive 52 percent year-on-year increase in export value.

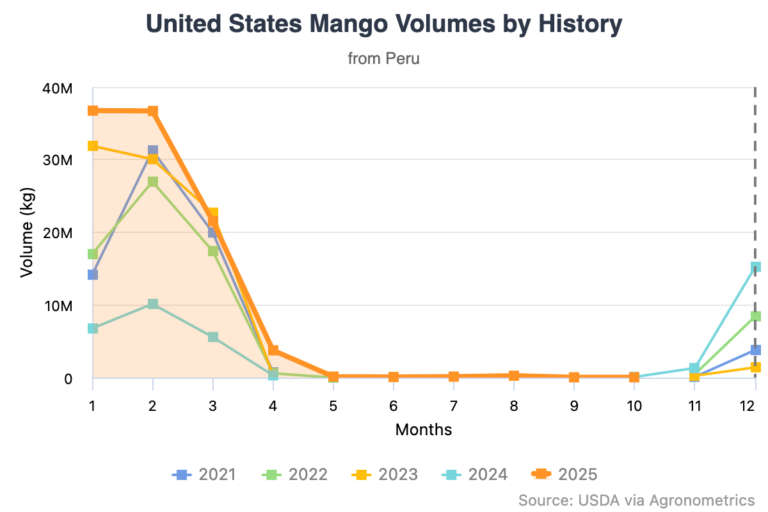

In volume terms, growth was even more remarkable: exports reached approximately 310,900 short tons, up 179 percent from the about 111,600 short tons shipped during the same period in 2024. However, this surge in volume came at a cost. Export prices fell 46 percent, a direct consequence of heavy availability in global markets and a rapid increase in Peru’s own seasonal supply.

Mango prices had already been under pressure through 2024, sliding steadily from about $1.27 per pound in January to roughly $0.54 per pound by year-end as oversupply—particularly from northern production regions—flooded the market. Although early 2025 brought a modest recovery, with prices climbing to around $0.86 per pound in May, they remain well below levels seen at the start of 2024.

The United States strengthened its role as Peru’s most important market, receiving $145.1 million in mango shipments—36 percent of Peru’s total export value—and about 113,400 short tons. This represents roughly double the value shipped in 2014, underscoring sustained growth over the past decade. The Netherlands followed as the second-largest market, importing $78.3 million (20 percent) and around 80,200 short tons, while Spain ranked third with $27.5 million (7 percent). Other notable destinations included Canada, South Korea, and the United Kingdom, all of which posted gains in both value and volume.

Peru’s mango sector also continues to diversify beyond fresh fruit. During the period analyzed, 55 percent of export value came from fresh mango, 38 percent from frozen mango, and 7 percent from other processed items, including dried mango, pulp, and purée. This ongoing shift toward higher-value processed formats reflects strategic efforts by exporters to reduce price volatility and expand market reach.

Source: USDA Market News via Agronometrics.

(Agronometrics users can view this chart with live updates here)

Related articles

The keys behind Peru's unprecedented 2025-26 table grape market expansion

Peruvian table grape season gaining momentum

Diversified agricultural strategy puts Peru on track for historic $14 billion export year