Agronometrics in Charts: California pear growers demand action against 125 percent import surge from Argentina

Each week, the series ‘Agronometrics In Charts’ looks at a different horticultural commodity, focusing on a specific origin or topic, and visualizing trade market factors that are driving change. Check out our entire archive.

California pear growers say surging imports from Argentina are threatening the future of an industry that once played a much larger role in the United States fresh fruit production.

“We really got our rear ends kicked this year by Argentine pears being in the marketplace when we started our harvest,” said Chris Zanobini, executive director of the California Pear Advisory Board.

According to Zanobini, California’s pear industry has steadily contracted over the past 25 years. At its peak, the state produced roughly 320,000 tons of pears annually. This year, production totaled about 107,000 tons, representing roughly 30 percent of total US pear output.

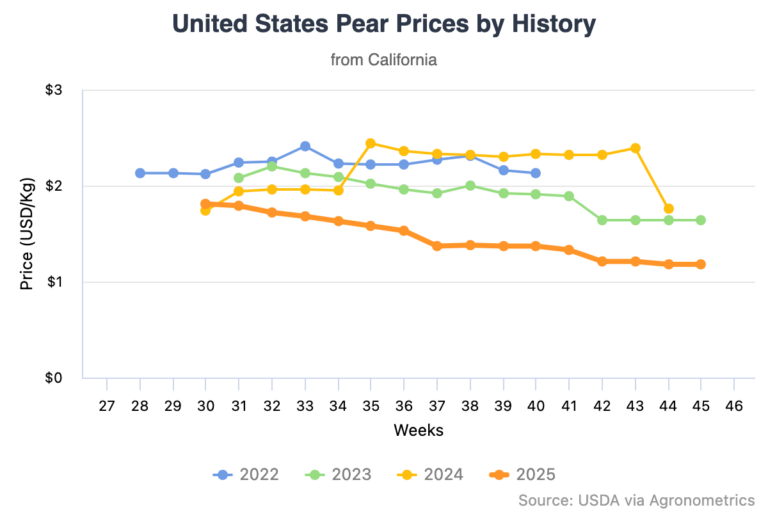

Source: USDA Market News via Agronometrics. (Agronometrics users can view this chart with live updates here)

Today, more than 60 growers farm around 4,000 acres statewide. While most of the crop, primarily Bartlett and Bosc pears, is destined for processing, California pear growers continue to emphasize the fresh market. Zanobini estimates that about 1.4 million 36-pound boxes are sold fresh each year.

Historically, California growers have coordinated closely with Pacific Northwest producers to avoid overlapping market windows, as the Golden State's fresh pear season typically begins earlier.

Since 2016, pear imports from Argentina have increased by an estimated 125 percent. The Andean country harvests pears in December and January, and the fruit is often treated with ethylene inhibitors that allow it to be stored for extended periods.

“Those pears can store for a very long time,” Zanobini said.

While Argentina supplies most pears to the US during winter months, Zanobini said roughly 70 percent of Argentine imports now arrive in April and May, just ahead of California’s harvest. This year, imports continued through September, overlapping much of the domestic season.

As a result, at least one major retailer delayed its California pear program by about a month, pushing back sales of roughly 10 percent of the state’s crop.

“And it was at a premium price,” Zanobini said. “That really hurt.”

US Department of Agriculture (USDA) pricing data shows a sustained downward trend for California pear prices throughout the 2025 season. Prices declined steadily from midsummer into the fall, culminating in a sharp drop of roughly 49 percent in week 43, according to the USDA.

Source: USDA Market News via Agronometrics. (Agronometrics users can view this chart with live updates here)

Growers say the timing and volume of imports are undercutting domestic prices and eroding market opportunities for fruit grown under stricter regulatory and environmental standards. Many California pear farms trace their roots back to the Gold Rush era, with multiple generations still in operation.

“We still have some of those same families that started back then, still growing pears,” Zanobini said. “Finally, our guys said enough’s enough.”

In response, industry leaders have begun discussions with the Office of the United States Trade Representative, exploring potential avenues for relief. Zanobini said the goal is not to eliminate imports, but to prevent imported fruit from undercutting US growers during critical market windows.

“We said the time and the opportunity are right now to try to get something to happen,” he said. “There are all these great things about producing fruits and vegetables in California, and I guess we have to fight for our right to do that.”

Related articles

Honeybear eyes steady pear import season

California pear growers seek USTR trade relief against surge of cheap Argentine imports