Shipping industry and U.S. tariffs—Navigating unknown waters

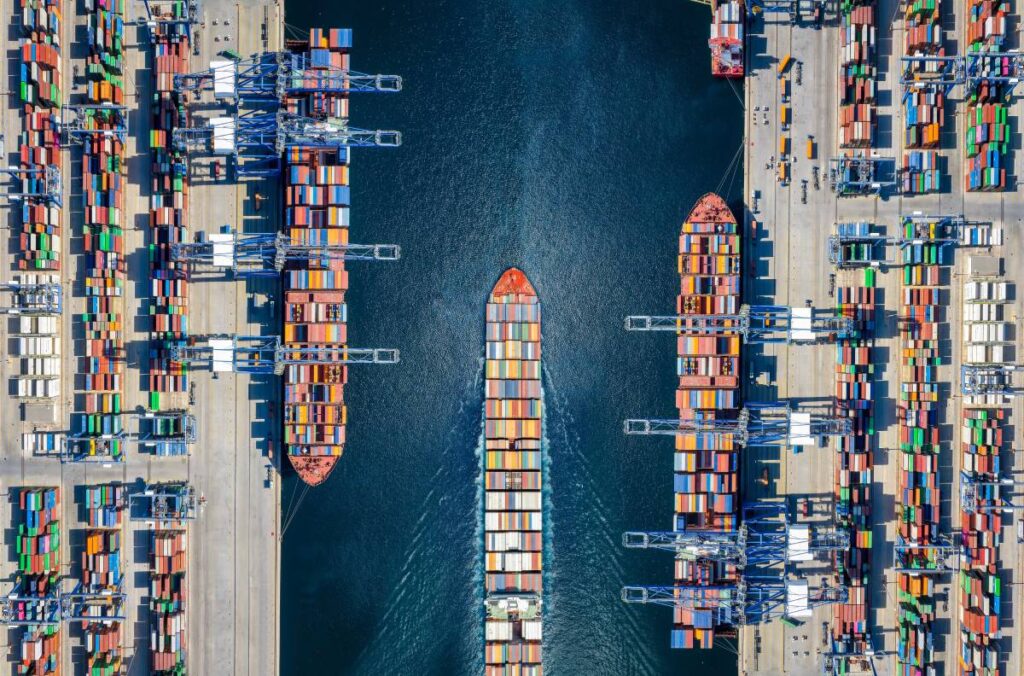

International commerce is not at a standstill, but it’s also fair to say that things are far from business as usual. Tariffs imposed by the Trump Administration against U.S. imports have wreaked havoc on the plans, schedules, and strategies of several exporting industries worldwide, with agriculture being one of the most brutally hit.

For the global shipping industry, new tariffs, exemptions, and deadline extensions have added to the ebbs and flows the sector has been experiencing since before President Trump’s election, further complicating an already unstable situation.

Just another (and another) layer of volatility

The shipping industry is, by nature, one of lengthy and costly processes hinging on tight schedules and thorough planning. The sector thrives on stability, and it is difficult to make changes to cargoes once a ship has literally sailed.

It would be easy to point fingers at the White House to explain the ups and downs in the shipping industry right now, but the truth is that changes in behavior predate the current occupants at Pennsylvania Avenue.

Darron Wadey, a consultant and shipping industry analyst at Dynamar, explains that changes began in October 2023. Back then, he says, shipping companies were making multi-million-dollar profits, a trend that everyone thought would continue well into 2024. “And then we had all these spikes because of the port workers' strike [in the U.S.],” he explains.

As the threat of a strike had been looming for a while, exporters' priority was to ship as quickly as possible to avoid disruptions. “There was a rush to get cargoes in, get them unloaded, into warehouses, and into the system so that they could be distributed later on.” In other words, volatility.

Fortunately, and even though the local press went into a frenzy, with headlines warning about rising retail prices and shortages, the strike only lasted a couple of days before the unions struck a deal. But then the election results in early November triggered another rush to get goods into the country before President Trump, who had promised ruthless import tariffs to bring manufacturing back to the U.S., took office. Yet again, volatility.

“If you see the price charts from last year to today, it’s a rollercoaster,” says Francisco Labarca, executive director at South Port Shipping. “We started August 2024 with record-high shipping rates because folks were trying to anticipate Trump’s tariffs.”

Things took another turn back on April 2nd, President Trump’s Liberation Day, when the head of state presented his tariff chart to the world. And it wasn’t just one dramatic turn, but several. Since then, the mandatary has imposed tariffs against exports from countries like Brazil, India, and China, as well as other lower but equally disruptive levies against Canada, Mexico, the EU, and several Asian countries. The announcements, as well as deadline extensions and product exceptions, have come in slow drips, creating a new normal in the global economy characterized by—you guessed it—high levels of volatility.

“There's a complicating factor because there's no uniformity in terms of the tariffs,” says Wadey. “Every single country is now rushing to try and renegotiate deals. And then there are deadlines arriving, and we've had deadlines that get extended—it's true volatility in that regard.”

Labarca also points out that market instability has not only affected shipping rates but also disrupted services. As the industry scurries to adapt to an ever-changing landscape, he explains, companies move equipment, reduce fleets, and relocate resources to make their operation as efficient as possible.

“All of these changes create traffic congestion at ports, with ships coming in out of schedule, and cargo left to wait for longer-than-average periods of time for transfer,” he says.”In other words, world logistics becomes a mess.”

A waiting game

Because of the rush to get goods into the U.S. before tariffs took effect, Wadey says that local warehouses have been well-stocked, which means consumers have yet to fully feel the hit from the tariffs. Once shelves start getting depleted and refilled by items entering the country under the new tariff regime, Americans will likely see the difference at the register. The resulting drop in general demand could directly impact the shipping industry, lowering rates on certain routes while favoring more profitable ones.

“Transportation is itself a derived demand,” explains the Dynamar expert. “You don't put a container on a ship because you like putting containers on a ship. You put a container on a ship because you've got cargo to be moved, and that is a function of the supply and demand.”

According to Wadey, the true impact of tariffs will be evident between October and November, but some are already seeing signs of a shifting American economy, including a 0.2 percent increase in inflation from June and 2.9 percent compared to July 2024.

On their own, these numbers don’t tell a dramatic story. What is dramatic, according to some experts, is how rapidly these numbers have gone up—the fastest inflation increase in the past five months—but whether this is a trend we can directly link to President Trump’s tariffs or something else is yet to be seen.

“It will calm down eventually. It has to,” says Wadey. “The ultimate decision comes from the United States consumer, and although a number of people are looking at investing in production capacity and capability in the U.S., that does not happen overnight.”

How to navigate tariff turmoil and not die trying

While the dust settles, commerce continues, and exporters will need to be particularly cautious if they want to avoid unexpected costs and surprises when shipping their products to the U.S.

Back at the beginning of August, global shipping industry giant Maersk made recommendations to its client base for navigating tariff-infested waters. Among the tips, the company encouraged exporters to:

- Review current low-value shipment practices and assess potential cost and compliance impacts.

- Evaluate tariff exposure across small parcel, e-commerce, and sample import channels.

- Conduct a classification, valuation, and origin audit to avoid inadvertent violations under the enhanced enforcement regime.

- Ensure robust record-keeping and compliance procedures in preparation for increased enforcement activity.

“You need to make sure all your T’s are crossed and your I’s are dotted,” says Wadey.

He emphasizes how complicated it can be to know exactly what’s going on at any given time (“It is changing daily, sometimes hourly! And then there are mixed messages that come out from different administration sources”), so he recommends staying up to date with White House announcements, as the landscape can change pretty quickly.

Labarca, who’s been in the business of shipping fruit out of Chile for 30 years, says the horticultural industry has particular challenges, but the focus should only be one. “What exporters need to do is get fruit to their destination in good condition. That is the most important thing,” he says.

He notes that even though Chile is facing a 10 percent tariff, his particular market has the advantage of a long Pacific coastline, which makes it easy to have several consolidated services to both of its largest trading partners: China and the U.S. Even though sailing to the latter usually means managing congestion and delays at the Panama Canal, the country’s location still plays in its favor.

Despite any advantages, tariffs can and will impact the entire trade ecosystem. The shipping industry is growing at an average annual rate of 7 percent, and this expansion, Wadey explains, brings with it the possibility of overcapacity. For the time being, this threat has been offset by geopolitical contingencies, such as congestion at the Panama Canal, instability at the Suez Canal, and an overall imbalance between routes sailing to and from Asia into the global North. But this is a fragile balance, and America’s trade policy might be the tipping point that pushes the shipping industry into correction mode. Because, at the end of the day, tariffs act as a deterrent for commerce, which just means less commerce.

Related stories

Trans-Pacific shipments and container rates spiking to U.S. West Coast

Major shipping companies won't be returning to the Red Sea soon

Cosco Shipping says U.S. actions on China's logistics and shipbuilding are discriminatory