Agronometrics in Charts: New varieties drive Chilean table grape industry shift, exports forecast to decline

Each week, the series ‘Agronometrics In Charts’ looks at a different horticultural commodity, focusing on a specific origin or topic, and visualizing market factors that are driving change. Check out our entire archive.

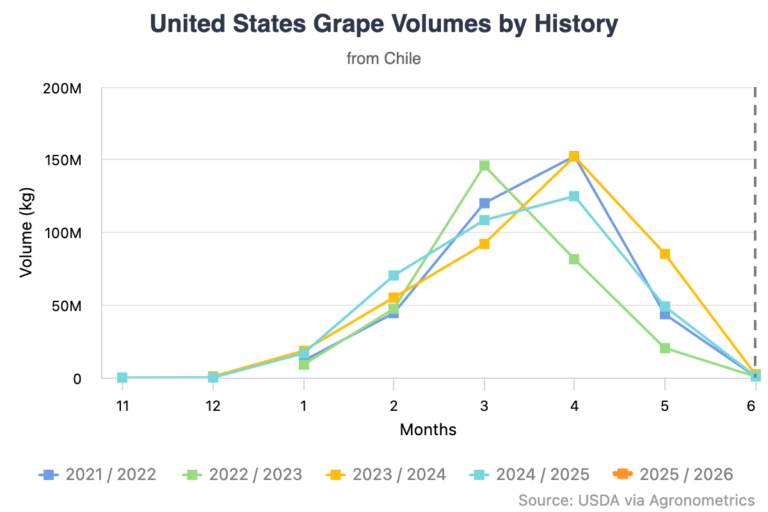

The Chilean table grape industry is bracing for a smaller export crop in the 2025-26 season, with early estimates pointing to 63.3 million cartons, a 6.9 percent drop compared to last year.

The figures come from the Chilean Fruit Table Grape Committee, which attributes the decline to the ongoing shift from traditional varieties to newer ones.

According to the committee’s executive director, Ignacio Caballero, the varietal transition is moving quickly but hasn’t yet made up for the volumes lost as older varieties are phased out.

Source: USDA Market News via Agronometrics.

(Agronometrics users can view this chart with live updates here)

New grape varieties are expected to account for over 44.9 million cartons, representing 71 percent of total exports, up from 67 percent last season.

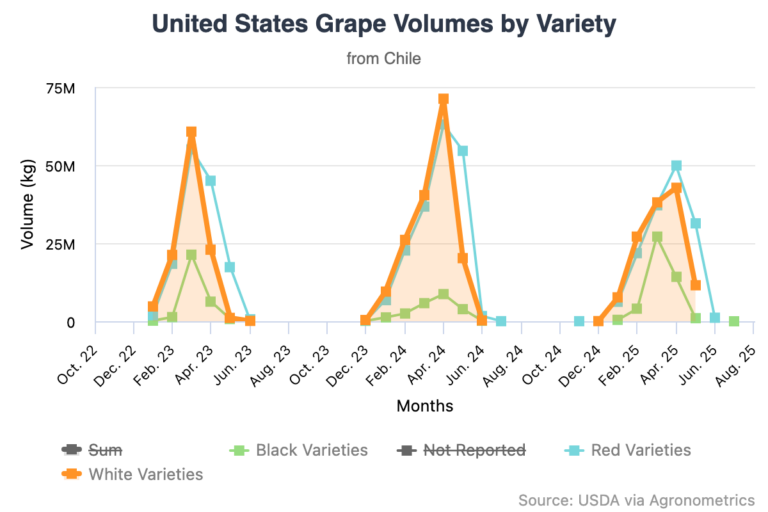

Red, white, and black grapes from these newer cultivars will make up the bulk of shipments, while traditional varieties are projected at around 8.7 million cartons. Red Globe, once the industry’s flagship, is forecast to fall to 9.5 million cartons, a 15 percent decline year-on-year.

White grapes are set to take the lead this season, making up around 40 percent of total exports, with more than 25.1 million cartons expected. Red varieties, excluding Red Globe, are forecast at 23.3 million cartons, while black grapes are estimated to reach 4.9 million cartons.

Source: USDA Market News via Agronometrics.

(Agronometrics users can view this chart with live updates here)

Among the newer varieties gaining traction are Timco, Allison, and Sweet Celebration on the red side. For white grapes, Arra 15, Timpson, and Sweet Globe are seeing strong uptake. In black grapes, Sweet Favors, Sable, and Sweet Sapphire continue to build their presence.

The harvest calendar for Chilean table grapes is expected to move slightly earlier this season, with peak activity likely between weeks 6 and 10. Even so, volumes during that window are predicted to be lower than last year.

All growing regions are forecasted to produce less fruit overall, although Coquimbo and Valparaíso are set to play a bigger role in total supply than in previous seasons.

Chilean table grapes' destination shift

In terms of market destinations, the outlook is mixed. Exports to Latin America are projected to rise by 14 percent, while shipments to Asia and North America are expected to decline by 18 percent and 9 percent, respectively.

The forecast is based on data submitted by committee members, who collectively handled 83 percent of the Chilean table grape exports last season.

“Varietal replacement is advancing and helping shape a better mix,” said Caballero. “The market is rewarding quality and condition, which is pushing demand toward newer varieties—particularly whites—and tightening the shipping window.”