IBO Report 2025: These are the five trends to watch in the blueberry industry

A little over a month after the publication of its 2025 report, the International Blueberry Organization (IBO) hosted a webinar to break down and analyze the document’s main findings, trends, and projections.

At the beginning of the session, IBO President Mario Steta took a moment to emphasize the collaborative nature of the report, which is based on survey data provided by the organization's members.

“The industry report is probably one of the best examples of an industry coming together and generating value,” he stated. “The more we see things evolving, the more we understand that data was, is, and will become even stronger on the logic of what business does, is, and wants to be.”

With over 200 pages of valuable industry insights, the 2025 IBO Report provides a comprehensive outlook on the global blueberry market.

Here are the five key trends that buyers, producers, and retailers should keep an eye on.

Peru has raised the bar—but it can only go so high

For all intents and purposes, the Peruvian blueberry industry didn't exist fifteen years ago. But it’s not necessary to be an insider to know that that is no longer the case.

The Latin American country went from being a bystander to becoming one of the leading stars of the blueberry industry, setting a new standard for quality, consistency, and availability.

Today, the IBO Report states that Peru is single-handedly carrying a third of the global blueberry output on its back, with export volumes projected to range between 350,000 and 400,000 tons, according to ProArándanos and the United States Department of Agriculture.

But all things come to an end, and even though there’s no end in sight for Peru’s main character era, new barriers are expected to slow the country’s sustained growth.

“Their labor is not infinite, land and water are not infinite, and so scaling is more difficult, more expensive,” says Cort Brazelton, editor in chief of the 2025 IBO Report. “The operating cost on a per unit, per hectare, or per kilo basis in Peru is actually higher now than some competitive high-chill growing operations in Chile and the Pacific Northwest.”

Brazelton emphasizes the Andean country’s advantages in terms of yield, timing, quality, and scale. However, he says there must be an inflection point on the horizon where Peru’s record-breaking growth curve starts to plateau.

Premiumization is driving growth—and splitting the industry in two

A quick glance at 2024 reveals that the general value for the blueberry category has increased significantly. However, a closer look shows that growth was not uniform across the market and that a lot of what was driving value was actually subcategories, the IBO Report says.

High-quality, better-flavored, better-marketed fruit is driving significantly higher ring value at the grocery store and a more compelling return to farmers.

“The key here is that it is not necessarily driving value in the same way to all parties,” Brazelton says.

This early stage of segmentation is tracing a clear line between premium products and the rest of the category, creating “a huge opportunity for sustained category development.”

“The industry is maturing, and we're entering a new phase. It's no longer about having blueberries—it's about having better blueberries and creating value to consumers and category segmentation,” he adds.

The blueberry growth paradox

The rise of premium blueberries has begun to segment the fresh category in the eyes of consumers. But there’s another side to that coin.

“We have uneven growth dynamics,” continued the IBO Report editor-in-chief. “There are industry participants, growing regions, and individual companies and growers that are capturing a disproportionate amount of the available growth in volume and margin.”

All the rest, Brazelton says, “are seeing the value growth outstrip volume growth.”

This dynamic results in a changing blueberry industry, presenting a rising risk of oversupply of generic products alongside a shortage of certain high-quality categories within the sector.

The IBO Report editor says blueberries have the potential to be the number one fruit (“They're just too convenient, too healthy, and too easy to eat”), but that doesn’t mean profitability is guaranteed.

“One of the big questions I have is how we will surmount these supply-side pressures to ensure growers are profitable, and continue to deliver to consumers what they want in terms of product quality, presentation, and price point,” he said.

Asia Pacific—The next frontier

Blueberries were once a category dominated by the Americas, both in terms of supply and demand, with the US and Canada consuming 90 percent of global production just a decade ago.

However, the blueberry map has started to shift.

“[Europe] and Asia Pacific have expanded rapidly, reflecting the crop's evolution into a truly global commodity,” said Agronometrics data scientist and part of the IBO Report editorial team, Sarah Ilyas.

The region now accounts for 38 percent of the world’s hectares dedicated to blueberry cultivation (only six percent less than the Americas) and is responsible for 35 percent of global production (11 percent less than the Americas).

“Asia and [Europe] together now produce more than half of the world's blueberries, confirming that this is no longer a Western Hemisphere dedicated crop,” continued Ilyas.

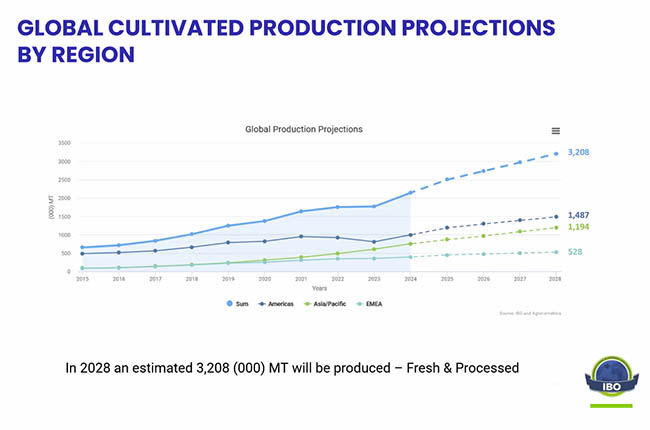

When it comes to global production, the team’s projections also indicate that the Asia Pacific region is gaining ground. Toward 2028, the IBO Report says, the Americas are forecasted to produce around 1,487 metric tons of blueberries, versus Asia’s 1,194.

However, the editorial team behind the IBO Report was adamant that the industry is currently undergoing significant changes and growing pains, making projections increasingly difficult.

Fresh might be losing (some) ground to processed

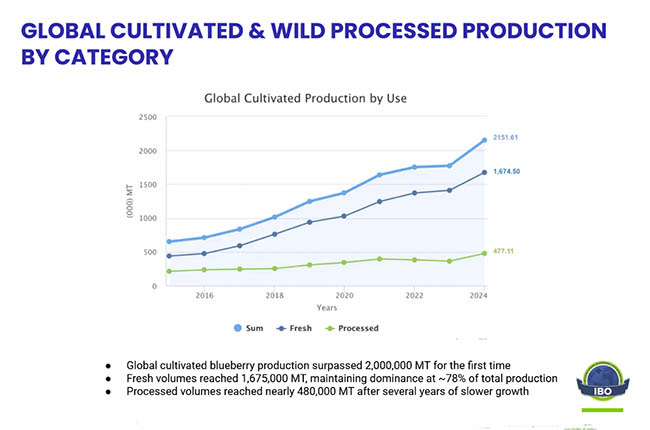

Before the turn of the millennium, the balance between fresh and processed blueberries within the category was historically 50-50, which later changed to a three-to-one ratio in the last 25 years.

However, according to the IBO Report, that gap has recently widened. In 2024, the ratio shifted roughly to 80-20, as growers favored the fresh segment over the processed one.

That might start to change slightly in the future due to varietal renewal. Brazelton explained that as new varieties enter the market, others will be phased out from the fresh side but remain on the ground.

“I think there are a number of countries where we'll see that happening. So I think we'll probably get back to a 70-30 breakdown, which would put us around 2.1 million metric tons fresh by 2028-29,” he said.

Once again, the IBO Report's editorial team was cautious about making projections, which might indicate that these numbers are on the conservative side of forecasts.

Related stories

Blueberry varietal transition—the berry fine line separating premium fruit from market confusion

IBO report shows continuous growth of blueberry industry in 2024

Blue skies ahead: US blueberries aim for new markets and tariff relief in push for expansion