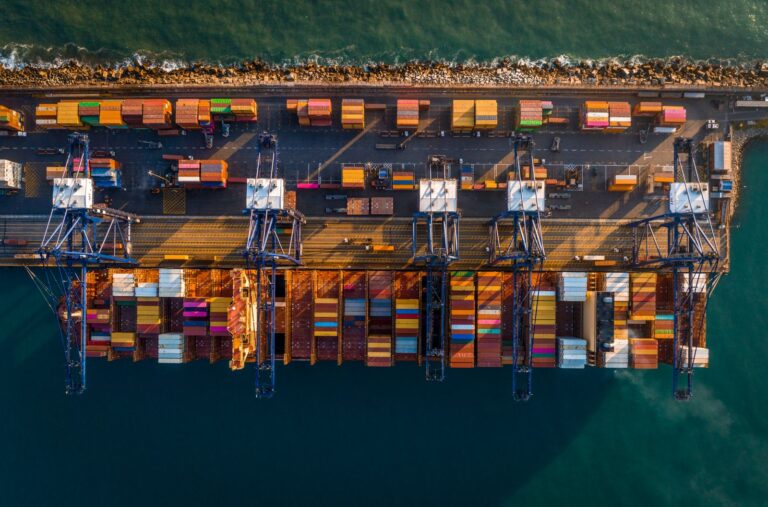

Global logistics experts split on 2026 US trade forecast, but agree container overcapacity looms

During a webinar analyzing the 2026 global shipping outlook, hosted by the Journal of Commerce, hope was not exactly the reigning sentiment. After a highly dynamic 2025, two of the three panel experts said they expect overall volumes to decline, which in turn means the stalling of US trade.

However, there seems to be a consensus over fleet overcapacity, which they say will be an issue for the industry next year, in part due to a decrease in market demand.

US trade: volume shift

John McCown, logistics analyst and owner of the global shipping data company The McCown Report, said he expects the year to start with double-digit volume declines and that will bleed well into 2026.

McCown expects total US inbound volumes in November to be approximately 14 percent lower year over year, and December will continue the downward trend.

He notes that US container volumes shifted from exceeding expectations in 2024 to underperforming in 2025. Since the US accounts for “about three quarters of that volume,” this decline reduced overall inbound container volumes in the region, even as global imports increased.

“In September, the last period available in terms of the data from CTS Container Create Statistics, we're down 5.2 percent in terms of inbound to North America,” he explained. “If you look at the rest of the world in terms of those imports, it's up 2.5 percent, and that gap is widening.”

However, containers are expected to operate at higher capacity.

“Capacity is coming on strong,” he explained, “I fully expect the carriers to make more aggressive use of doing what they can to control capacity.”

Carriers brace for tough year ahead

John McCauley, logistics consultant and former vice president at US global shipping company Cargill, also anticipates continued demand decline next year. While tariffs contribute, he primarily attributes the decrease to “slack consumer demand overall in the US.”

According to the Container Tracker API Vizion, weekly TEU bookings in most of September, October, and November were lower than last year, which points to a slowing in consumer goods demand.

“If that cycle of downturn of consumer demand continues, I think we're going to really see a significant problem of ongoing demand from the container space,” he explained.

Carriers will be affected by the reduction in demand, which could result in defaults and mergers. The freight forwarding industry will also struggle, McCauley explained.

Despite wanting to see the bright side of things, he said, the volumes in other major regions, such as Europe, are not great either and smaller economies don’t have enough pulling power to turn things around.

He added that because of limited income, people will try to get more bang for their buck next year.

“Rates are going to go down and everyone's going to be scrambling to try to get as much volume as possible,” concluded McCauley.

A slightly less bleak outlook

Ines Nastali, S&P Global Market Intelligence's senior supply chain analyst, didn’t have as bleak an outlook for the US.

“We're busy seeing the decline of trade this year, but then going to see an increase next year again, once people have gotten more comfortable with the tariffs coming out of the US,” she explained.

Nastali said global trade is in contraction for now, and in the US is only looking at a tariff-related downturn. However, she agreed that overcapacity will not get any better next year.

“We will continue to see this overcapacity grow,” she said, adding that lower steel prices may also reduce ship recycling next year.

Related stories:

Shipping industry and U.S. tariffs—Navigating unknown waters