Persimmon season starts late, but marketing muscle keeps retailers in the game

A warmer-than-normal autumn might have pushed back early color development in Giumarra Companies’ Fuyu persimmon crop—but the changing weather did not affect the company’s confidence. Regional Business Development Director Gary Caloroso tells FreshFruitPortal.com that promotable volume “remains strong” and quality is “outstanding”.

Despite the later start, the LA-based company expects the shipping window to run close to its usual pace. The firm continues encouraging retailers to lean into fall and winter promotions—when consumer interest in the fruit typically peaks.

“Persimmons continue to be a great choice for seasonal fall and winter promotions, such as family gatherings during the holidays and to enjoy while watching football,” Caloroso adds.

The Golden State produces about 99 percent of the persimmons enjoyed in the US, with imports from Chile and Israel supplementing the market during the spring months. Sales continue to gain momentum, according to Melissa’s Produce Director of Public Relations, Robert Schueller.

While Fuyu and Hachiya remain the two main commercial cultivars, making about 95 percent of the market, Schueller notes that consumers are embracing less common varieties with more unique looks.

“Chocolate persimmons have a brown flesh on the inside, while the cinnamon persimmon has little brown dots,” Schueller explains. “[At Melissa’s] We’ve been carrying that cinnamon persimmon for fifteen years now, and it’s really been about consumer education.”

A persimmon playbook

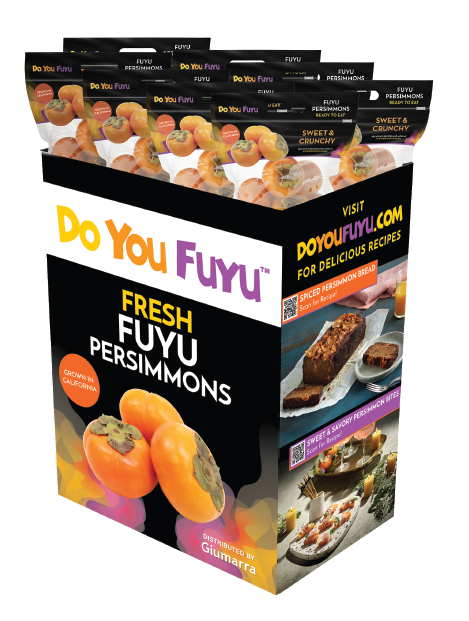

Giumarra reports that overall fruit quality across its product lines remains strong, with size and total volume tracking closely with last year. The company offers both bulk and bagged Fuyus, Hachiyas, and its proprietary Sugar & Spice persimmons in ready-to-eat bagged formats.

Caloroso notes that retailers can expect consistent options and that “a variety of sizes” is currently available to meet customer needs. He adds that Giumarra plans to meet the later start with an expanded suite of marketing tools.

“We offer a comprehensive Fuyu persimmon marketing program to help our customers boost sales and drive consumer interest in this increasingly popular exotic fruit,” Caloroso said.

Central to the effort is DoYouFuyu.com, a platform Caloroso described as crafted to “educate and inspire shoppers about the versatility, flavor, and nutrition of Fuyu persimmons.”

Alongside the site, Giumarra provides a toolkit that brings together education, in-store merchandising materials, packaging resources, contest concepts, social media content, original photography, recipes, and nutrition information. It is designed to give retailers a full-season promotional roadmap without needing to build programs from scratch.

The rising popularity of Fuyus comes as no surprise to Schueller. Melissa’s noted a five percent growth in sales for the variety. While usually consumed fresh, persimmons have also found a niche as a baking ingredient, he notes.

“Whether it’s Halloween, Thanksgiving, Hanukkah, Christmas, or New Year’s, they are enjoyed out of hand or cut onto a charcuterie board,” he says. “The cooking variety, the Hachiya, can be used in baking, similar to ripe bananas used in bread or muffins.”

High Brix, high hopes

As global persimmon shipments rebound and international suppliers prepare for stronger 2025 volumes, Giumarra maintains that domestic and imported fruit play complementary roles rather than competing directly.

“As one of the largest shippers of persimmons in the United States, we remain dedicated to increasing domestic consumption. Imported persimmons operate within a different shipping window and therefore do not compete directly with our program,” Caloroso says.

He emphasizes that broader consumer interest elevates the entire category.

“Each year, we provide promotable domestic volume along with tailored marketing support to help our customers grow their sales to shoppers,” the executive notes. “Increased consumer interest in the persimmon category is beneficial for both domestic and import programs.”

Giumarra’s long-term priorities center on expanding national demand—and elevating its exclusive Sugar & Spice variety as a signature differentiator.

“We are dedicated to continuing the growth of persimmon demand across the United States and are especially proud of our Sugar & Spice persimmons,” Caloroso said. He highlights the variety’s flavor features and culinary versatility.

“These acorn-shaped, ready-to-eat fruits feature a naturally sweet flavor with subtle notes of fall baking spices. They are delicious, enjoyed on their own or as a flavorful addition to salads, desserts, and appetizers,” he said.

*All photos courtesy of Giumarra.

Related articles