Agronometrics in Charts: Piura mango industry under strain as market conditions worsen

Each week, the series ‘Agronometrics In Charts’ looks at a different horticultural commodity, focusing on a specific origin or topic, and visualizing trade market factors that are driving change. Check out our entire archive.

The Piura mango season in the San Lorenzo Valley, Peru, is moving forward under growing strain.

During the 2025/26 campaign, producers have been hit by falling prices and sharply lower yields, prompting farmers to temporarily suspend harvesting and sales for five days to avoid deeper losses.

Prices have been the main pressure point for Piura mango producers. Growers report that the price of a 21-kilo box dropped significantly in a single week, pushing many operations below production costs. This has been compounded by reduced output, with yields in the valley estimated to be down by up to 70 percent compared with a normal season.

Piura continues to face difficulties

The main agro-export products from Piura are grapes, mangoes, limes (Tahitian and Sutil), blueberries, and bananas.

The city is the second most important region for Peru’s agricultural industry, contributing 13 percent of the region’s GDP and 4 percent of the national GDP, and has faced adverse weather in recent years.

These local difficulties contrast with Peru’s continued relevance in export markets.

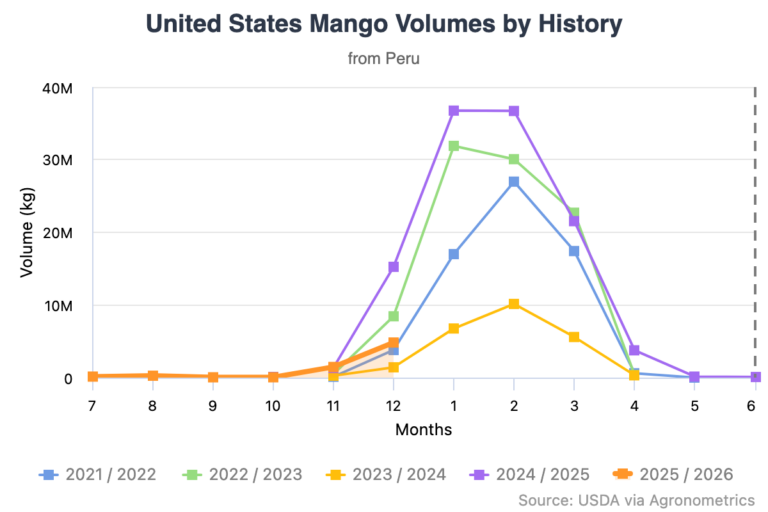

According to figures from the US Mango Board, the Peruvian mango season began in the second week of October and is expected to run through the first week of April, with a projected volume of about 21.2 million boxes.

Kent remains the dominant variety, accounting for 93 percent of shipments, followed by Ataulfo/Honey at four percent and other varieties at three percent.

By the week ending January 17, 2026, Peru had shipped approximately 2.7 million boxes that week, bringing the season total to 10.76 million boxes. Over the same week in 2025, shipments were lower at 2.06 million boxes, though the cumulative total that season stood higher at 17.72 million boxes.

Despite steady export movement, weaker prices, slower market absorption, and overlapping shipments from Ecuador continue to weigh heavily on growers in Piura.

Source: USDA Market News via Agronometrics. (Agronometrics users can view this chart with live updates here)

Related articles