Agronometrics in Charts: Peruvian avocado imports surge as US retailers broaden sourcing

Each week, the series ‘Agronometrics In Charts’ looks at a different horticultural commodity, focusing on a specific origin or topic, and visualizing market factors that are driving change. Check out our entire archive.

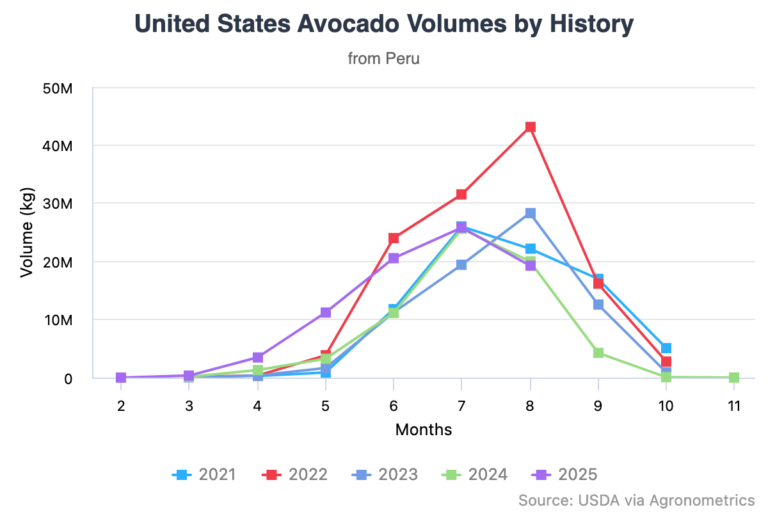

US Peruvian avocado imports increased by approximately seventy-five percent this spring and summer, surging from an estimated 58.9 million kgs in 2024 to about 104.3 million kgs in 2025. The expansion reflects both an “on year” in Peru’s production cycle and a deliberate shift by American buyers toward multi-origin procurement, as retailers seek to ensure year-round availability and greater flexibility in fruit size and quality.

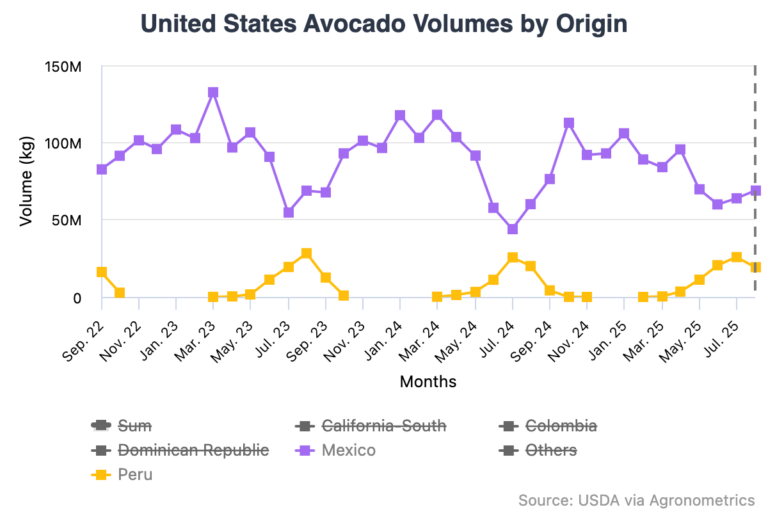

Pre-season trade outlooks anticipated a shipping window exceeding 90.7 million kgs between May and September from Peru; actual volumes concluded near the upper bound of those projections as quality remained strong and sizing ranged from medium to large. Market observers also noted that Peru temporarily occupied the position of second-largest supplier during several peak weeks, underscoring the speed with which diversification is reshaping the category in the US market.

The Peruvian Avocado Commission reinforced the crop with tailored retailer support: e-coupons, point-of-sale materials, and advertising circular integrations, as well as community activations designed to sustain consumer engagement. On National Avocado Day, for example, the organization’s “Guac-Off” events included a sizable donation to a major regional food bank, drawing local media coverage and incremental store traffic for participating partners.

In the broader context, US avocado demand remains robust while South American export capacity continues to expand, suggesting an increasingly competitive and multi-origin summer slot. Peru’s reliability, sustainability positioning, and marketing investment point to continued presence through October, even as Mexico remains the principal year-round anchor of U.S. supply.

Source: USDA Market News via Agronometrics.

(Agronometrics users can view this chart with live updates here)

Source: USDA Market News via Agronometrics.

(Agronometrics users can view this chart with live updates here)

Related stories

Social media in uproar over alleged cadmium presence in Peruvian avocados

Peru adjusts avocado export projection for 2025 by 20% less than March estimate