Grapes in Charts: How will Chile's expected crop affect U.S. market against backdrop of low prices?

In this ‘In Charts‘ series of mini-articles, Colin Fain of data visualization tool Agronometrics illustrates how the U.S. market is evolving. In each series, he will look at a different fruit commodity, focusing on a different origin or topic in each installment to see what factors are driving change.

Unseasonably low pricing in the U.S. table grape market has many in the industry on edge. Especially as expectations of high inventories threaten to have an impact on the seasons of Peru and Chile. So this week I want to look at the numbers and see what we can discern from the situation.

US Monthly Grape Shipping Point Historical Prices

(Source: USDA Market News via Agronometrics)

While the current prices are in fact the lowest average monthly price we have seen in our datasets for November, this is not without cause. After a huge harvest, this is also the most volume recorded for the month by the USDA that we make available in Agronometrics. Throw on top of that limited exports for fruit that might have otherwise been sent to China and the resulting situation is inevitable.

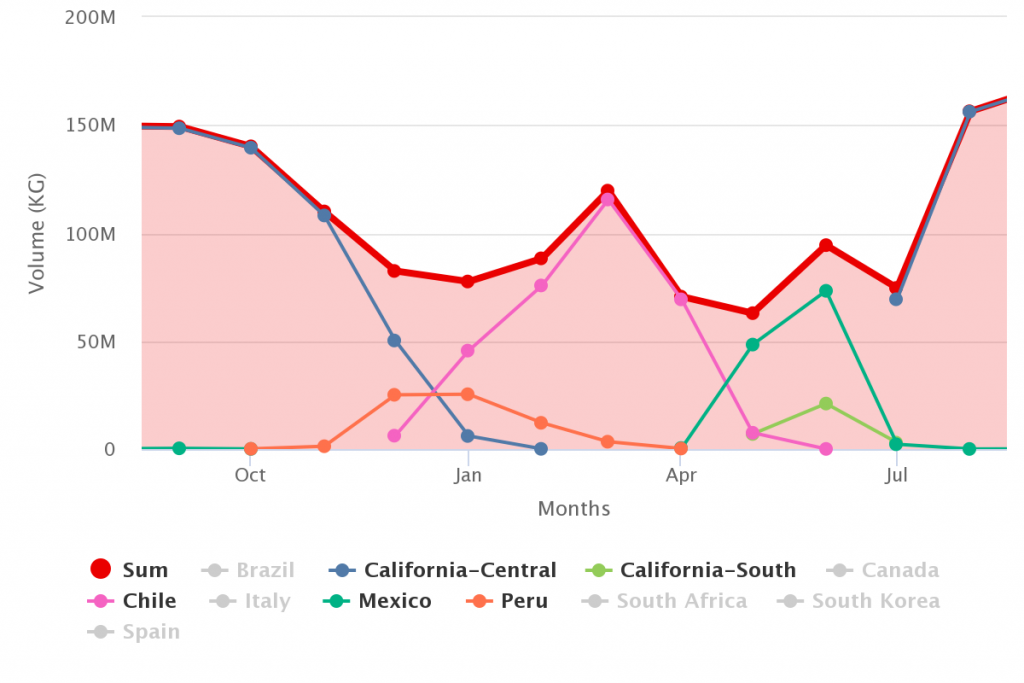

US Monthly Grape Historical Volumes (KG)

(Source: USDA Market News via Agronometrics)

I wrote about Peru in a previous article which can be seen here, so I’ll focus this segment on Chile.

Chile occupies a strategic spot in the U.S. market, counter-seasonal to California and bordered by Peru and Mexico, coming in right as prices begin to rise and supplying the U.S. with the bulk of their grapes during the winter months.

US 2017-18 Grape Volumes by Origin

(Source: USDA Market News via Agronometrics)

The season typically follows a pretty established trend, starting out high before dipping in January, February and March to help move the bulk of the volume, and coming back up again in April as volumes drop and U.S. demand picks up with warmer weather.

US Volumes and Prices of Chilean Grapes (September 2015 - Present)

(Source: USDA Market News via Agronometrics)

Even considering damage from the massive hailstorm that Chile recently suffered, the Chilean Table Grape Committee is expecting volumes only 2% lower. It seems however that the hail is not the primary cause of the drop in volume, but a rejuvenation of the varieties. Some have argued that this change has been a long time coming - and with the prices that some of the newer varieties are fetching, it’s easy to see why.

US Shipping Point Prices from Chile by Variety 2017-18

(Source: USDA Market News via Agronometrics)

So as we take into account smaller volumes from Chile, I think that the most likely scenario will be prices lower than they otherwise would be at the start of the season as we wait for volumes from California's over-production to clear up. That said, there is clearly a preference for new fruit, as Peru’s prices have already been fetching a healthy premium against the outgoing California crop. Assuming the forecasts are accurate, I would expect for prices to be higher than what we were seeing last year for Chile, especially in February, March and April, where most of Chile’s volumes are concentrated.

US Shipping Point Prices by Origin

(Source: USDA Market News via Agronometrics)

In our ‘In Charts’ series, we work to tell some of the stories that are moving the industry. Feel free to take a look at the other articles by clicking here.

Agronometrics is a data visualization tool built to help the industry make sense of the huge amounts of data that you depend on. We strive to help farmers, shippers, buyers, sellers, movers and shakers get an objective point of view on the markets to help them make informed strategic decisions. If you found the information and the charts from this article useful, feel free to visit us at www.agronometrics.com where you can easily recreate these same graphs, or explore the other 23 fruits we currently track, creating your own reports automatically updated with the latest data daily.

To welcome grape professionals to the service we want to offer a 10% discount off your first month or year with the following coupon code: GRAPES

The code will only be good till the 25th of December 2018, so visit us today.