Oranges, lemons and avocados a bright spot as fruit sales dip below 2019

Oranges, lemons and avocados were the only top 10 selling fruits to see double-digit sales growth in the U.S. retail sector last week, as the sales in the category dipped below last year's levels for the first time since early March.

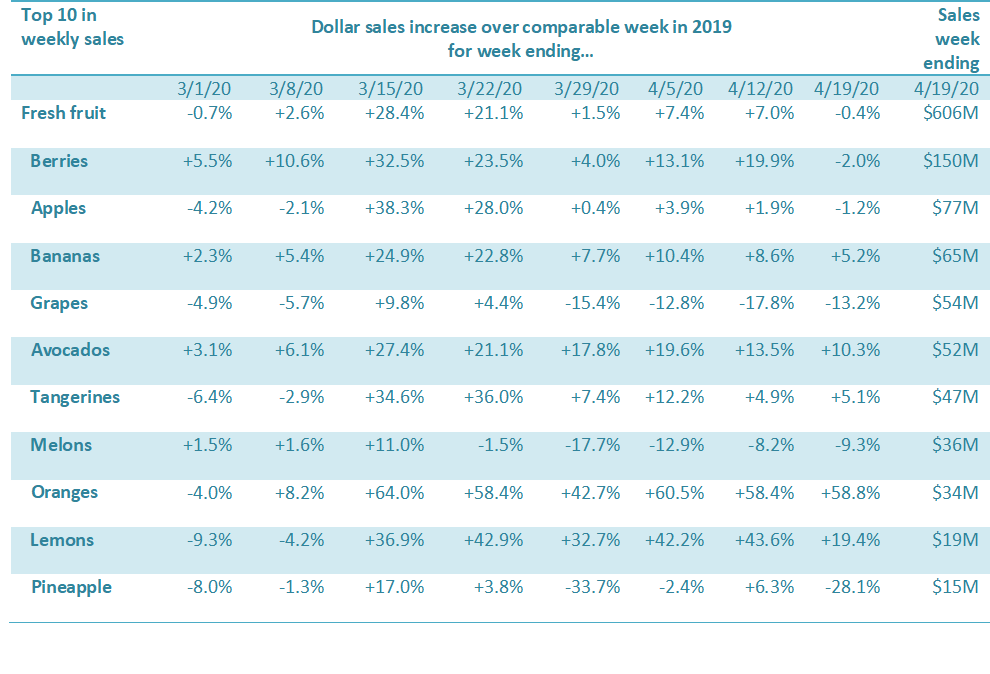

Fresh fruit sales last week were 0.4% lower year-on-year in the week ending April 19, while fresh vegetables were up 7.7% and fresh produce overall was up 3.3%, according to Nielsen data cited in a report by 210 Analytics, IRI and PMA.

While the figures mark the lowest growth levels in around two months, they came amid numerous market restrictions and were competing with Easter week in 2019.

“We knew it was going to be hard to beat prior year Easter numbers,” said Joe Watson, VP of Membership and Engagement for the Produce Marketing Association (PMA).

“While no longer showing double-digits, it is encouraging that the elevated everyday demand generated continued gains."

Going into the summer, he said, it is important to keep the momentum for vegetables going and build strong demand for fruit, despite the vastly different trip and spending patterns.

"A number of high-impulse summer fruits are around the corner and we have to challenge ourselves to build impulse sales in new ways and within a new reality, including online ordering, trip pressure and a desire among shoppers to minimize time spent in-store," he said.

In the week ending April 19, sales of fresh oranges were up 58.8% year-on-year, lemons were 19.4% higher and avocados were up 10.3%.

Bananas and tangerines were the only two other top 10 fruits in terms of total sales to experience year-on-year increases, both growing by just over 5%.

Berries - which remain the biggest seller by far - saw sales decline by 0.4%, while apples were down 2% and table grapes fell by 13%. Melon and pineapple sales were also down, by 9.3% and 28.1% respectively.

'In-home consumption is here to stay'

Since the onset of the coronavirus sales patterns, fresh vegetable growth has far exceeded that of fruit, and the week ending April 19 was no exception.

Fresh vegetable sales growth (+7.7%) was more than 8 points higher than that of fruit, but it was also the first time that gains fell to single-digits.

Compared with the same week in 2019, fresh produce generated an additional US$51 million in sales.

“I have no doubt about it, in-home consumption is here to stay for the foreseeable future,” said Jonna Parker, Team Lead, Fresh for IRI.

“Fresh produce sales numbers this week had multiple headwinds to overcome in terms of going up against Easter 2019, deflation, SKU rationalization, purchase limits, some consumer concern over the safety of bulk fresh items, but also the rise of online ordering.

"We typically see an initial hesitation to order fresh items online, particularly meat and produce, though shoppers often move past this if they continue to order online. This could also be one of the reasons why we’re seeing frozen and shelf-stable produce sales continue to do so well.”

In the week ending April 19, sales of frozen fruit and canned and frozen vegetables were up significantly year-on-year - by between 25% and 38%.

What's next?

Anne-Marie Roerink, president of 210 Analytics, said that as April draws to a close, there is still great uncertainty about the state-by-state decisions on “re-opening” the country.

"Some states began lifting their executive orders for non-essential businesses whereas others have indefinite shelter-in-place mandates," she said.

"Only South Dakota remains free of statewide government restrictions that require businesses to close."

The reopening of restaurants in some states may provide an indicator of consumers’ mental readiness and economic ability to re-engage with foodservice.

"For the foreseeable future, it is likely that grocery retailing will continue to capture an above-average share of the food dollar," she said.

"Next week’s sales results will reflect a regular week in both calendar years and may provide some indication of how far the new baseline will lie above the old normal.

"In addition to many consumption occasions having shifted to at-home, more than 26 million Americans have filed for unemployment in the last four weeks and economic pressure typically translates into more meal preparation at home."