Agronometrics in Charts: Low temperatures impacting Hass avocado volumes out of Chile

In this installment of the ‘Agronometrics In Charts’ series, Sarah Ilyas studies the state of the Chilean avocado market. Each week the series looks at a different horticultural commodity, focusing on a specific origin or topic visualizing the market factors that are driving change.

A 13-year drought is straining Chile’s freshwater resources, from the Atacama Desert to Patagonia. By the end of 2021, the fourth driest year on record, more than half of Chile’s 19 million population lived in an area suffering from severe water scarcity.

Additionally, low temperatures and frosts observed in recent weeks in the central valleys of Chile (Valparaiso, Metropolitana, and O'higgins) have damaged part of the Hass avocado production.

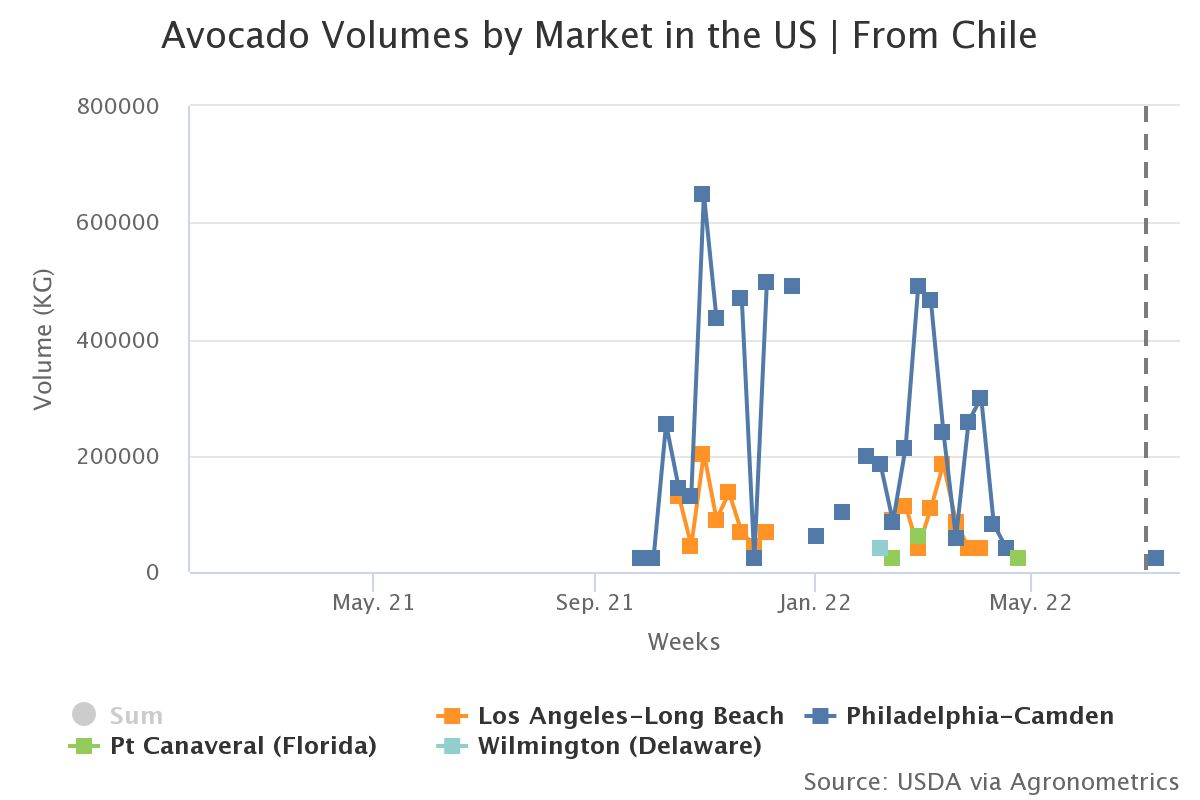

According to local suppliers and exporters, avocado production in Chile is expected to fall for the 2022-23 season by between 20% and 35%. The 2021-22 season, however, saw sizable volumes of up to 852 K kgs in week 43.

Source: USDA Market News via Agronometrics. (Agronometrics users can view this chart with live updates here)

The first scientific study on the environmental impact of avocado production in Chile was carried out in February.

The study is titled ‘State of the environmental art of Persea americana Mill plantations in Chile’ and was developed by the Regional Water Center for Arid and Semi-Arid Zones in Latin America and the Caribbean (CAZALAC by its acronym in Spanish), with the participation of the Chilean Avocado Committee.

The results of the study indicate that avocado production is efficient in the use of water resources, given that there is a wide technified irrigation area, which allows the approximate consumption to be 8,930 cubic meters per hectare.

The study also concludes that fruit tree plantations, including avocados should be reduced in the province of Petorca to avoid greater pressure on the resource since this area has been the most affected by the drought. Between 2013 and 2020 the agricultural area went from 14,000 to 4,000 hectares, precisely because of the water shortage.

Despite the scarcity of water, Chile is renowned for producing high quality avocados. Eighty nine percent of the avocados planted in Chile are the Hass variety.

Demand for avocados is strong from both the domestic market and the export market, which has pushed prices upwards in the past two marketing years. The top export destinations for Chilean avocados are the Netherlands, Argentina, the UK, and the United States.

Source: USDA Market News via Agronometrics. (Agronometrics users can view this chart with live updates here)

In our ‘In Charts’ series, we work to tell some of the stories that are moving the industry. Feel free to take a look at the other articles by clicking here.

All pricing for domestic US produce represents the spot market at Shipping Point (i.e. packing house/climate controlled warehouse, etc.). For imported fruit, the pricing data represents the spot market at Port of Entry.

You can keep track of the markets daily through Agronometrics, a data visualization tool built to help the industry make sense of the huge amounts of data that professionals need to access to make informed decisions.

If you found the information and the charts from this article useful, feel free to visit us at www.agronometrics.com where you can easily access these same graphs, or explore the other 21 commodities we currently track.