Agronometrics in Charts: Super Bowl brings massive US avocado consumption amid tariff threats

This week on ‘Agronometrics In Charts’, we dive into the impressive avocado demand during the Super Bowl, when staple preparations include the so-called "green gold" as a key ingredient. Check out our entire archive.

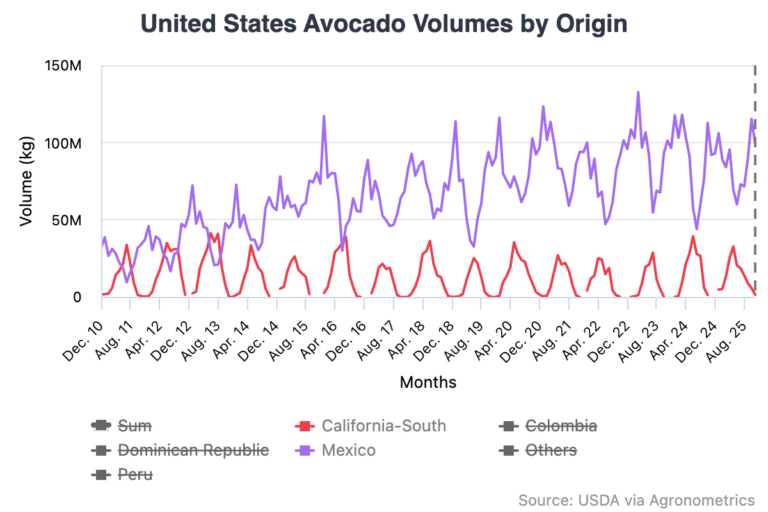

Despite recurring tariff threats and ongoing trade uncertainty, Mexico continues to anchor the United States avocado supply, accounting for about 90 percent of the fruit's availability as demand remains strong heading into Super Bowl 2026.

Avocados have become a staple at US household gatherings, with Big Game Sunday standing out as one of the year's largest consumption events due to strong demand for guacamole.

While the Trump administration has threatened a 25 percent tariff on all Mexican imports, avocados currently remain tariff-free under the US-Mexico-Canada Agreement (USMCA), provided they meet rules-of-origin requirements.

Proposed tariffs that could have affected avocado availability ahead of the 2025 Super Bowl were paused to avoid supply disruptions. Industry experts say that even if the levies were enacted, US buyers would likely continue sourcing avocados from Mexico due to limited alternatives.

News outlet Mexico Business News has stated that no other country in the world can supply the American market year-round like Mexico.

Super Bowl demand meets supply constraints

Domestic avocado production remains insufficient to meet US demand. In the 2024-25 marketing year, California produced about 375 million pounds of avocados, up three percent from the prior season.

That volume remains small compared with more than two billion pounds of avocados imported annually, primarily from Mexico.

Supply pressures extend beyond trade policy. Drought conditions in Mexico have reduced yields, while US production, concentrated largely in California, continues to face drought, wildfire risk, and other adverse weather that can affect both yield and quality. Historical pricing data also show that avocado prices typically rise ahead of major consumption events such as the Super Bowl.

Despite these challenges, US consumption and imports of Mexican avocados remain strong heading into Super Bowl 2026 and are expected to remain elevated even amid tariff uncertainty and environmental pressures.

The next major inflection point for North American produce trade will come with the scheduled USMCA review in July 2026, which could influence future agricultural trade flows and reshape long-term supply chains for avocados and other commodities.

Source: USDA Market News via Agronometrics.

(Agronometrics users can view this chart with live updates here)

Related stories

Avocado market expecting new dynamics following Super Bowl and Chinese New Year

Avocado volumes poised to smash 3 billion pound record in 2025

California avocado crop could be "one of the most robust in recent years"

California Avocado Month kicks off with successful social media campaign