Avocados in Charts: Prices are jumping, will this year be like 2017?

In this installment of the ‘In Charts' series, Colin Fain of Agronometrics illustrates how the U.S. market is evolving. Each week the series looks at a different horticultural commodity, focusing on a specific origin or topic visualizing the market factors that are driving change.

Last week saw avocado prices take a healthy jump from an average of US$33.28 to US$38.89. Interestingly, this jump comes on the same week as prices rallied in 2017. The question we are left with is: will this season develop like 2017, which saw some of the highest pricing that the market has seen from weeks 7 to 12?

Non-organic avocado prices reported

(Source: USDA Market News via Agronometrics. View this chart with live updates here)

So far, things look to be developing very much in line with 2017. The latest pricing data for week 8 puts the pricing at around US$46, following a trend that is very close to 2017.

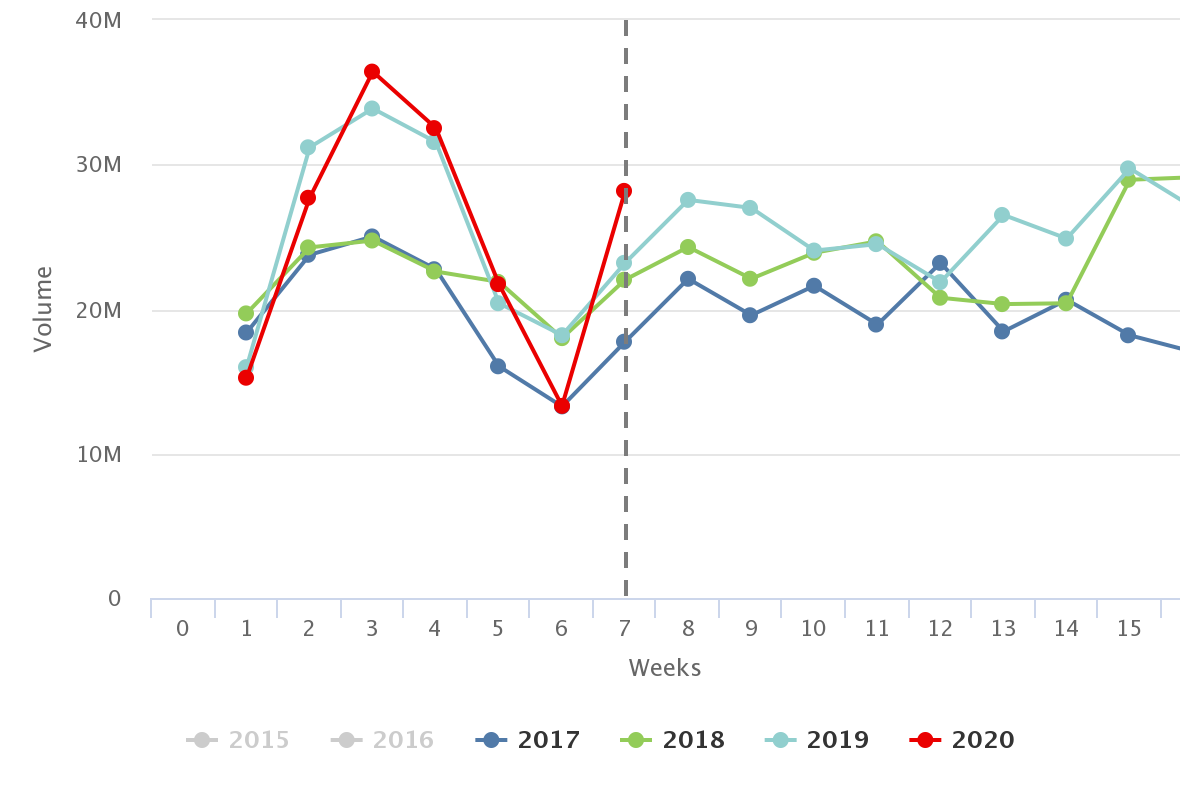

If we look at the volumes though, the story is dramatically different, where 2017 saw consistently low volumes through week 25, 2020 saw some of the largest volumes ever recorded leading up to the Super Bowl, dropping off dramatically in week 6 only to jump up again to record levels in week 7.

Non organic avocado volumes reported

(Source: USDA Market News via Agronometrics. View this chart with live updates here).

Merely looking at pricing through historic data isn't enough to get the big picture. However, the avocado industry is fortunate to be able to rely on the forecasts published by the Hass Avocado Board (HAB) to help shed light on what the industry is expecting.

In the latest report made available through the HAB website on week 8 of 2020, the forecast expects volumes to remain at similar levels to 2019 through this week before the volumes are expected to jump up.

By averaging forecasted volumes from week 9 to week 13, we can calculate an expected increase of 16.5% over last year's volumes, a massive rate of growth and easily the largest volume this time period has seen in the categories history.

With this information in mind, I would not expect high prices to be maintained. The most the market has been observed to grow was 10% year over year, with the average rate of growth closer to 7%.

This means that if volumes were to grow by 7% pricing would remain the same as last year, at twice that rate of growth I expect that pricing will fall below last year's level in pretty short order. Given the volumes that are already arriving on the market, I would be surprised if the current high prices don't start to fall before the end of week 9.

In our ‘In Charts’ series, we work to tell some of the stories that are moving the industry. Feel free to take a look at the other articles by clicking here.

You can keep track of the markets daily through Agronometrics, a data visualization tool built to help the industry make sense of the huge amounts of data that professionals need to access to make informed decisions. If you found the information and the charts from this article useful, feel free to visit us at www.agronometrics.com where you can easily access these same graphs, or explore the other 20 fruits we currently track.