Peru has officially surpassed longstanding leader Chile and solidified its position as the world's leading exporter of table grapes, according to a recent report from RaboResearch.

The Andean nation has experienced sustained growth in shipments over the last couple of years, supplying an unprecedented 4.6 million tonnes in 2024/25, representing record volumes for the country.

However, its #1 spot is far from secure. With projected exports exceeding 100 million boxes, China is not far behind, and the Asian Giant is expected to transform the global table grape landscape by the end of the decade.

According to the report, Peru's success reflects the growing competitiveness of the sector and a shift in the known power balance among exporters. Peru’s growth is also opening new opportunities for market diversification, the report says.

Among the industry’s new horizons, Southeast Asia appears as a strategic and particularly attractive destination for exporters.

There’s a wide range of elements that paved the way in Peru’s rise to the top. Among them, industry analyst firm Agronometrics names the country’s expansion of productive area and export capacity, especially for seedless and green-variety grapes.

Investment in logistics, cold chain infrastructure, and supply chain reliability, as well as improved varietal development and yield management, have also played a role. Additionally, strategic market diversification has enabled Peru to reduce its overdependence on a few large buyers.

This repositioning presents both challenges and opportunities for established producers in Chile, South Africa, and other regions, according to Agronometrics.

In Asia, China drives table grape supply and demand, supported by the growth of its middle class and changes in consumption habits.

"As China becomes more self-sufficient, it relies less on imports, consolidating its position in the global table grape industry," explained Gonzalo Salinas, senior analyst at RaboResearch.

Chinese exports are projected to exceed 100 million boxes in the coming years, according to Agronometrics.

In North America, US exports remain stable, the expert says, with retail expansion and promotional strategies driving notable growth in markets like Mexico.

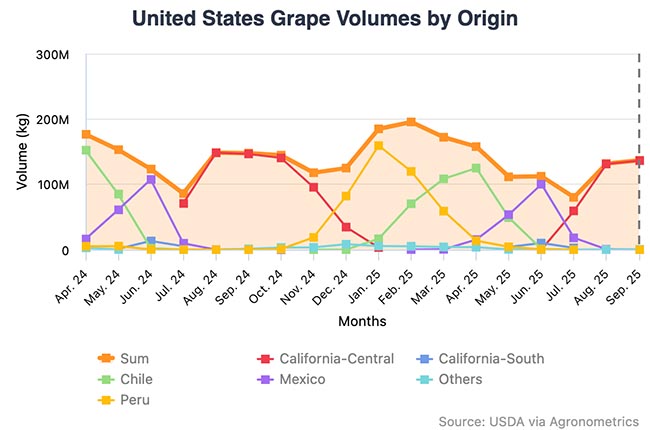

Graph by Agronometrics.

South of the border, the table grape industry remains resilient, benefiting from constant demand in both the United States and domestic markets.

Despite previous climatic disruptions, South American exports have recovered, reaching a record 1.3 million metric tons. This bounceback has laid the groundwork for sustained growth in 2025/26.

At the other end of the supply chain, the European Union and the United States remain the largest importers of table grapes, accounting for 43 percent of the global volume. In the last decade, imports in these markets have grown steadily at an annual rate of two percent.

In the United States, per capita consumption has been on the rise over the last decade, averaging 8.2 pounds per person annually. Projections are setting a record 9 pounds for 2025/26.

Finally, Southeast Asia is emerging as a compelling alternative for market diversification. "The region's growing demand presents untapped opportunities for exporters seeking strategic growth in new destinations," concludes Salinas.

Related stories

Chile still reigns supreme over US table grape imports—but Peru is closing in

Looking ahead: Chilean and Peruvian table grape industries push for collaborative work