Decofrut presents the State of the Market for table grapes during April, looking at supply, demand and pricing for three markets over the last month- in the U.S., Europe and China.

Despite the logistical complications and the constant increase in coronavirus cases in mainland China, over the month of March there was an increase in the quantities of imported table grapes in the wholesale markets of the Asian giant, mainly white seedless grapes, with a stagnation of arrivals towards the end of the month.

Most of the batches came from Peru, followed by Chile and also registering small volumes from South Africa and Australia. The increase in the volumes of red seedless and black seedless grapes in the markets, which were mainly contributed by Chile, should be highlighted.

As for sales, they continued to show regular movement, emphasizing a certain preference for the Red Globe and red seedless varieties, which registered a relatively faster inventory turnover, compared to the other varietal groups.

Considering the supply, Sweet Globe and Autumn Crisp, belonging to the black seedless grape group, together with Red Globe continued to be the dominant varieties in the markets. As for red seedless, the supply consisted mainly of Crimson Seedless and Ralli Seedless, while for black seedless grapes the main variety was Sable Seedless.

Considering the prices of the last month (week 9 to 13), the black seedless grape averaged a similar price to the previous month (week 5 to 8), closing at US$4.70/kilo, a figure below last season by 8 percent. In the Red Globe category, prices were also traded at a value similar to last month, at US$2.90/kilo (-21 percent compared to the previous year). The red seedless grape group was quoted for US$4.85 (+18 percent monthly; +20 percent annually). Lastly, the black seedless grape registered an average value of US$4.40/kilo (+13 percent monthly; -9 percent annually).

During the month of March, a wide availability was registered in all the varietal groups, noting the peak of Chilean arrivals in each one of them.

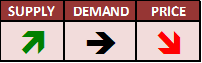

Hand in hand with good availability, prices fell, while demand remained unchanged. For its part, the condition of the fruit has been heterogeneous, mainly in white seedless and red seedless varieties, while port delays continue, complicating estimates regarding arrival dates. The offer is concentrated in Chilean fruit, although there is still a good Peruvian availability.

Regarding the volumes traded on the open market, these were 19 percent higher than the previous month, with the southern hemisphere as the only origin. Regarding the prices of the month, imported seedless whites averaged US$3.15/kilo, together with a monthly variation of -20 percent and an annual variation of -6 percent; in red seedless, the average was US$2.12/kilo, varying by -38 percent compared to February and -14 percent compared to 2021.

For the same month; in black seedless, the average value was US$2.46/kilo, decreasing 32% per month, while registering 21% below the previous year; in Red Globe the average price was US$2.48/kilo, together with a monthly difference of -20 percent and an annual difference of +11 percent.

During the month of March, the demand for table grapes in Europe remained fairly stable and the offer was varied, mainly consisting of a wide range of South African grape varieties. Lots of Peruvian grapes were added to the stocks, as well as those from Namibia, whose presence decreased towards the end of the period. Chile and India completed the offer, with varieties such as Thompson Seedless, Sweet Globe, Sugraone, Red Globe (RG), Timco, Crimson Seedless and Flame Seedless.

The fruit with the best quality and condition was well accepted by consumers, while the batches with problems, mainly red seedless grapes, had difficulties being sold. Due to the natural increase in supply, prices for seedless grapes gradually trended downward (more markedly in the second fortnight); while for Red Globe, prices remained relatively stable (with slight variations according to origin and format).

Within the supply, white seedless grapes were found in a lower proportion than red seedless grapes, so for this group a more empty market was perceived. It should be noted that the shipping companies' delay not only continued to affect the weekly availability of table grapes, with shortages in some and oversupply in others, but it also played an important role in the quality and condition of some items.

Finally, regarding prices, as a reference, during week 13 of 2022, the overseas white seedless and red seedless varieties in punnet format were offered at an average sale price of €2.45/kilo; while, in the case of Red Globe, the prices averaged €2.15/kilo (4.5-kilo box) and €2.20/kilo (8.2-kilo box) for the Peruvian offer.